Inside Alachua County’s code chaos

Inside Alachua County’s code chaos

How a rogue building official is flouting state law – and costing homeowners

By Skip Foster, Red Tape Florida

The inspection dispute that unfolded on a jobsite in Alachua County wasn’t an isolated flare-up. It was a window into a system that has drifted far from what Florida law requires.

Under state statute, a licensed private provider becomes the inspector of record. Yet Alachua County routinely sends its own inspectors anyway — and often shows up without the private provider present, issues findings, cancels inspections, and tells contractors they may not proceed until the county signs off.

This is more than duplication. It is the county substituting its own authority for the one the Legislature created, and the result is predictable: delays, confusion, and costs ultimately borne by the homeowner.

One case illustrates the problem. The pattern tells the real story.

Florida’s Legislature rewrote the law to give property owners a choice. They can use government inspectors or hire licensed private-sector experts who must meet equal or higher professional standards. Private Providers carry personal liability, carry stronger licensing obligations, and often have deeper expertise in individual trades than the government staff reviewing their work.

But in Alachua County, that choice has become an illusion. When property owners hire private providers, the county inserts itself anyway, rewrites the process, duplicates inspections, invents new requirements, and demands that contractors bow to a shadow system that appears designed to make private providers’ work slower, harder, and less viable.

And the man driving that system, Building Official Dan Gargas, has a history that makes the pattern difficult to dismiss.

In 1999, the Record-Courier newspaper in Ohio reported that Gargas had been fired twice as a building director in Streetsboro. In a formal termination letter, the mayor cited complaints from the construction trades, complaints from the public, codification errors, unjustified fee increases, budget disputes, and what she called “an unacceptable lack of accountability.”

Gargas has since hopped around – Monroe County, Fla., Lakeland, perhaps other areas – with the circumstances of his departure unclear.

Regardless, the echoes today of his time in Ohio are hard to miss.

The county that doesn’t want private providers to succeed

Florida Statute 553.791 is clear: when a private provider is engaged, that provider becomes the inspector of record. The local building official may audit, but may not duplicate inspections. The goals are efficiency, competency and accountability.

Alachua County has decided otherwise.

County leadership has invented a new category called “Private Provider Inspection Confirmation” — a phrase that appears nowhere in the statute. On paper, it sounds like simple verification. In practice, these “confirmations” are full duplicate inspections. County inspectors show up unannounced, redo the work the private provider already performed, issue correction notices without sharing them with the private provider, and tell contractors they must wait for county approval even when state law says otherwise.

The message is unmistakable: if you choose a private provider, Alachua County will inspect you again anyway. And again. And again.

At that point, why would any contractor risk the delays, confusion, or double-jeopardy created by a county that simply refuses to accept the legitimacy of private-sector expertise?

And remember, these added costs and delays eventually are passed down to homeowners.

The notice trap: how Alachua County rewrites state law by portal glitch

The Legislature eliminated the old rule requiring next-day notice by 2 p.m. Private providers now must simply give an approximate date and time of inspection.

Alachua County has rejected that.

They refuse email notifications.

They require scheduling through a county portal that doesn’t allow same-day appointments.

They claim the statute somehow forbids same-day notice even though the text explicitly allows it.

The result is predictable: contractors get blamed for “improper notice,” even when the only impediment is the county’s own system.

The law gives flexibility. The county erases it. And private providers take the hit.

Withheld reports and one-sided communications

In multiple cases, Alachua County has sent inspection findings directly to contractors — listing deficiencies, cancellations, or demands for reinspection — while failing to send those same reports to the private provider responsible for the job.

This breaks their own written policy. It also sabotages the provider’s ability to resolve issues promptly.

When the county tells a contractor “you may not proceed without approval from Alachua County,” after the private provider has already approved the work, the county is not protecting safety. It is undermining the statutory authority of the private provider.

This is discrimination through paperwork.

The county invents permits to stall jobs

During one visit in November, the county abruptly informed a contractor that the project required two new permits: one for lighting and one for the dumpster on-site.

The lighting permit was an error. The dumpster permit was an invention.

The dumpster was shown on the approved plans. No such permit requirement appears in Alachua County’s code. The public inspection log does not show a visit that would have identified it earlier. Yet this new requirement appeared after two unannounced site visits and was delivered as a condition of proceeding.

This is regulation as improvisation, not law.

A registration system the county ignores

Florida statute allows local governments to create a one-time registration system to verify a private provider’s license and insurance. Once registered, the provider should not have to re-submit documents for every permit.

Alachua County denies permits anyway, claiming the certificate of insurance is “missing” even after registration is complete.

This is friction for friction’s sake — another attempt to discourage private-sector participation.

Audit authority rewritten by semantics

Florida law limits a building official to four audits per year per private provider — and only after the building department audits its own staff for two consecutive quarters.

Alachua County appears to have completely skipped the self-audit requirement. Instead, they conduct multiple visits to the same job within days and label them “code checks,” claiming they are not audits and thus not subject to statutory limits.

Calling an audit a “code check” does not make it legal.

It simply exposes the motive: keep private providers under constant pressure until they leave the county or stop competing.

The qualifications question: who is actually the most competent?

Private provider inspectors are often more qualified than the county staff reviewing their work.

Many private providers:

- hold multiple state licenses

- have decades of trade experience

- carry personal liability for their work

- maintain stricter continuing-education requirements

- undergo direct oversight from DBPR and state licensing boards

Many county inspectors:

- do not hold equivalent trade licenses

- have less recent field experience

- face minimal personal liability

- are shielded by government employment protections

- may audit work they are not technically qualified to perform

This is the root of the hostility.

The private sector threatens the county’s monopoly.

The county responds by creating rules designed to push private providers out.

A statewide problem? No. An Alachua County problem.

CT Solutions works in 181 jurisdictions across Florida.

Only Alachua County behaves this way.

Citrus County plays by the statute. In fact, most counties welcome private providers because they ease workloads and accelerate construction.

Alachua County treats them as an enemy.

And when a building official, once fired for “unjustified fee increases” and “complaints from the trades,” begins redefining inspections and inventing permit hurdles, it’s worth asking whether history is repeating itself — and whether contractors and property owners are paying the price.

December 12, 2025Skip Foster, Red Tape Florida

The Case of the Missing Sheriff: Why Brian Littrell’s Beach Dispute Exposes a Bigger Problem

When Backstreet Boys member Brian Littrell bought a stretch of beachfront property in Santa Rosa Beach, he likely didn’t expect the Walton County Sheriff’s Office to play the role of absentee landlord. But that’s exactly what’s alleged in a new legal petition filed this month. […]

July 25, 2025The Case of the Missing Sheriff: Why Brian Littrell’s Beach Dispute Exposes a Bigger Problem

When Backstreet Boys member Brian Littrell bought a stretch of beachfront property in Santa Rosa Beach, he likely didn’t expect the Walton County Sheriff’s Office to play the role of absentee landlord. But that’s exactly what’s alleged in a new legal petition filed this month.

Littrell claims that, despite repeated reports of trespassers crossing onto his deeded beach, sheriff’s deputies refused to intervene — citing vague jurisdictional rules and unclear direction from county leadership. Translation: “Not our problem.”

This isn’t just a celebrity property dispute. It’s a window into how local red tape — in this case, through inaction rather than overreach — can leave taxpayers holding the bag for services they’re already paying for.

A Legal No-Man’s Land

In Florida, the line between public and private beach is supposed to be clear: sand below the mean high-water mark belongs to the public, while sand above it — if deeded — is private. But in practice, that line is invisible. And when county law enforcement refuses to enforce property rights above it, homeowners are left to defend their land themselves.

That’s exactly what Littrell is now doing. In his petition, he says he’s been forced to pay out of pocket for private security just to keep trespassers off his property — all while still paying taxes that fund the very law enforcement agency declining to act.

The Walton County Sheriff’s Office declined to comment on the pending legal matter. A public records request by Red Tape Florida turned up no current policy or directive governing beach trespass enforcement.

The Politics of Non-Enforcement

This isn’t the first time Walton County has punted on beach-related governance. In 2018, under pressure from the state, the county repealed its customary use ordinance — which had allowed the public to access privately owned beach areas — sparking years of legal and political battles.

Now, in the vacuum left behind, enforcement appears to be optional. But optional for whom?

This case reveals the dangers of selective governance: when public officials shy away from enforcing established rules because the issue is politically hot, regular citizens — even famous ones — get left behind.

The Red Tape at Work

At Red Tape Florida, we spotlight government dysfunction in all its forms — whether it’s regulatory overload or bureaucratic cowardice. This case is the latter.

If citizens must pay out-of-pocket to enforce their own legal rights, then we’re no longer just talking about bad governance — we’re talking about a fundamental failure of public duty.

Walton County doesn’t get to stay silent forever. The taxpayers — and beach owners — deserve a straight answer.

July 25, 2025

Commenters Gone Wild: When Facebook Fury Misses the Point (and the irony)

There’s no more fitting tribute to Red Tape Florida’s recent piece — “The Red Tape Machine Doesn’t Get Its Start in City Hall. It Cranks Up in the Comments.” — than the actual Facebook comments reacting to it. […]

July 24, 2025Commenters Gone Wild: When Facebook Fury Misses the Point (and the irony)

There’s no more fitting tribute to Red Tape Florida’s recent piece — “The Red Tape Machine Doesn’t Get Its Start in City Hall. It Cranks Up in the Comments.” — than the actual Facebook comments reacting to it.

You can’t parody this stuff. In the very thread responding to a story about how grassroots outrage creates red tape, commenters lined up to — wait for it — fuel the very outrage machine that begets red tape. It’s a meta-loop of performative fury.

The story made a pretty simple point: bad public process doesn’t begin in a conference room at City Hall. It starts when political leaders are bombarded with contradictory, emotional demands from people who may or may not have even read the proposals they’re railing against. Leaders over-correct, stall, and then wrap a simple plan in a hundred-page binder to appease the masses. Thus: red tape.

And then the comment section delivered — with full-volume fury and not a whisper of irony:

• “This was done behind closed doors.”

• “They already paid off the commissioners.”

• “All the politicians are bought.”

• “Same sh*t, different day. The politicians are all corrupt.”

Let’s pause here: These comments were made under a post of the actual story that explains what happened — a story that exists for the very purpose of dragging sunlight into the process. And yet, folks still lined up to type angrily that “no one’s talking about this.”

And by the way, all those comments are maliciously false.

Irony doesn’t get much more pure than that.

Let’s be clear: frustration over development, traffic, tree loss, and neighborhood change is valid. But righteous anger loses its edge when it becomes a reflex rather than a reasoned contribution. And when that anger hits Facebook before it hits a planning meeting, what happens is exactly what this thread illustrates — the civic version of shouting at clouds.

A few of the comments get closer to a real conversation — one asks why all the homes are going up in Northeast Tallahassee while other parts of the city sit idle. Another makes a fair point about lot sizes and tree cover. But instead of thoughtful exchange, they’re buried under accusations of bribery, developer cartels, and some half-baked call for criminal prosecution.

Here’s the punchline: the very people who are most upset about local government dysfunction are often the ones unknowingly helping to cause it. When we argue from a position of ignorance, delay becomes the fallback. When we expect scandal, officials lawyer up. And when we insist that every pothole hides a conspiracy, we turn real planning into risk management theater.

So yes — Tallahassee may have a development problem. But it also has a comment section problem, which then becomes a “t-shirt brigade” problem at public meetings, before whom local leaders all too often cower.

And until we reckon with all that, the red tape machine will keep humming — powered not by bureaucracy, but by the very people shouting at it from their phones.

July 24, 2025

Here’s the church, there’s the steeple … wait, why are some of them being taxed?

Tallahassee’s fire service fee is back in the news — and once again, city leaders are finding new ways to explain something that doesn’t make sense to begin with.

This time, the controversy is over churches: some are being billed, others aren’t. The rules are murky, the enforcement inconsistent, and the legal fight is already underway. But the real issue isn’t confusion — it’s principle.[…]

July 16, 2025Here’s the church, there’s the steeple … wait, why are some of them being taxed?

Tallahassee’s fire service fee is back in the news — and once again, city leaders are finding new ways to explain something that doesn’t make sense to begin with.

This time, the controversy is over churches: some are being billed, others aren’t. The rules are murky, the enforcement inconsistent, and the legal fight is already underway. But the real issue isn’t confusion — it’s principle.

Here’s the bottom line:

No church should be paying this fee. Not now. Not ever.

1. The Fire Fee Is a Tax in Disguise — and Churches Are Exempt from Taxes

Tallahassee can call this a “special assessment” all it wants, but functionally, it’s a mandatory government fee imposed on properties to fund a core public service: fire protection. And Red Tape Florida has already written about questions regarding how the City of Tallahassee uses these funds.

In other words, it’s a tax — and in Florida, churches and religious organizations are constitutionally exempt from taxation when their properties are used for religious or charitable purposes.

You don’t get to slap a new label on the same old scheme and pretend the Constitution no longer applies. This is a backdoor tax — and it doesn’t belong on a church’s doorstep.

2. Churches Earn Their Exemption — Because They Serve the Public

This isn’t about churches looking for special treatment. It’s about recognizing the critical civic role they play.

There are over 200 houses of worship across Tallahassee and Leon County. According to national averages, these congregations contribute 20%–30% of their budgets to direct community outreach — from food pantries and utility assistance to addiction recovery, housing aid, and disaster response.

Assuming a reasonable average budget of $350,000 per church, that puts direct financial community support in Tallahassee at more than $23 million annually.

And that’s just the start.

Add the value of volunteer labor — conservatively estimated at $14.5 million/year — and donated facility space for AA meetings, civic events, and emergency shelters, and the total annual contribution by churches easily exceeds $30 million.

Let that sink in:

Churches are quietly contributing $30–40 million a year to the public good.

They don’t need to do less of that to pay a tax.

And while we’re on the subject of fairness, let’s be honest about compensation. The average Tallahassee firefighter earns over $60,000 a year in salary alone — before overtime and benefits. Compare that to the average pastor of a local congregation, who often makes half that amount (if that), or the median income for Leon County residents, which sits around $50,000. In that context, asking churches and modest nonprofits to subsidize fire operations through a glorified tax feels not only unconstitutional — it feels upside down.

3. The Real Problem Is the Fee — Not the Exemption

Some will argue that everyone should pay their share. But that logic falls apart when the mechanism is this flawed.

The fire fee is regressive — meaning lower-income households pay proportionally more than wealthier ones. It’s confusing — with different rates for different zones and unclear exemption rules. It’s under legal attack — for good reason. And it now puts the city in the absurd position of deciding which churches count as religious enough to deserve an exemption.

That’s not tax policy — that’s red tape in its most dangerous form.

4. This Isn’t Church vs. State — It’s Common Sense vs. Bureaucracy

Let’s not make this political or theological. You don’t have to be religious to understand that churches, synagogues, mosques, and faith-based ministries are on the front lines of community care.

When government policy ignores that — or worse, punishes it — something’s broken.

The fire department deserves funding. But it should come from transparent, equitable, legally sound taxation — not a patchwork fee system that burdens the poor, confuses the public, and taxes Tallahassee’s most charitable institutions for doing their job.

July 16, 2025

A call for tax relief: City of Tallahassee should counter surge in property values

Tallahassee residents are about to see another increase in their property tax bills — not because City staff is proposing a millage rate hike this year, but because it doesn’t have to. Property values across the city have surged, and if the current rate of 4.45 mills holds, tax bills should increase by an average of 8.69%. […]

June 8, 2025A call for tax relief: City of Tallahassee should counter surge in property values

Proposed new City of Tallahassee budget would result in an 8.69 percent average increase in property taxes

Tallahassee residents are about to see another increase in their property tax bills — not because City staff is proposing a millage rate hike this year, but because it doesn’t have to. Property values across the city have surged, and if the current rate of 4.45 mills holds, tax bills should increase by an average of 8.69%. That increase comes on top of last year’s decision to raise the millage rate from 4.10 to 4.45 — the first hike in seven years. In other words, this is a compounded increase, and residents are right to be concerned.

This year’s tax burden is driven not by new city policy, but by a changed economic landscape. A combination of inflationary pressures and reassessments has led to significantly higher property valuations. And while that may be a sign of a growing city, it also puts strain on homeowners, especially those on fixed incomes or just starting out.

State law gives cities the choice: hold the rate steady and collect more money, or roll back the rate so residents endure a smaller increase. With a projected increase of nearly 9% in taxable value, now is the time to do the latter.

It’s not that the city isn’t making good use of public funds. This year’s proposed budget shows investments in affordable housing, infrastructure, parks, and public safety. Long-deferred capital projects are moving forward, and the city is taking steps to improve transparency and financial resilience. Those are commendable efforts and should be applauded.

But there is also some contradiction – spending money on affordable housing program, then adding to the property tax bills of homeowners by an average of almost 9 percent is obviously counterintuitive.

Sound budgeting doesn’t mean maximizing revenue every time the market allows it. True fiscal responsibility is about balance — weighing the government’s needs against the capacity of its residents to fund them. In this case, a reasonable course of action would be to modestly reduce the millage rate to neutralize the spike in property values. Doing so wouldn’t threaten core services. It would simply give homeowners a break after two years of upward pressure.

The City Commission has an opportunity to show leadership and restraint. A full or partial rollback would send a powerful message: that Tallahassee’s leaders are listening, and that growth in revenue shouldn’t automatically mean growth in taxes.

As budget workshops and hearings approach, the Commission should take a close look at the numbers and ask not what is legal or permissible, but what is fair. An 8.69% increase in property taxes, following a millage hike last year, is too much for many residents to absorb.

This is a defining moment for our city’s fiscal identity. Are we a government that quietly lets tax bills rise through valuation? Or are we a community that takes pride in being proactive, responsive, and responsible with every dollar?

By adjusting the millage rate downward, the City Commission can protect the public’s trust while continuing to invest in Tallahassee’s future.

June 8, 2025

Reducing Barriers to Licensing Could Address Dentistry Shortage in Florida

The Health Resources and Services Administration (HRSA), an agency of the U.S. Department of Health and Human Services, indicates that Florida is the worst state in the nation for dental access.

Currently, 65 of Florida’s 67 counties are designated, either in full or in part, as dental health professional shortage areas, with population-to-dentist ratios exceeding 5,000 to 1.[…]

June 6, 2025Gabriel Carraro de Andrade

Reducing Barriers to Licensing Could Address Dentistry Shortage in Florida

Author, Gabriel Carraro de Andrade is a recent graduate and research intern at the DeVoe L. Moore Center in the College of Social Sciences and Public Policy at Florida State University where he majored in economics.

The Health Resources and Services Administration (HRSA), an agency of the U.S. Department of Health and Human Services, indicates that Florida is the worst state in the nation for dental access.

Currently, 65 of Florida’s 67 counties are designated, either in full or in part, as dental health professional shortage areas, with population-to-dentist ratios exceeding 5,000 to 1.

This has left over 7.1 million Floridians living in “dental deserts.”

According to HRSA, an additional 1,536 dentists are needed just to eliminate the current shortages. Lafayette County in the Big Bend has no dentists at all, and there are several other counties where the ratio is as low as one-tenth of the national average. This is a critical issue, as dental health is as important as general health care.

A Florida Workforce Survey regarding dental care professionals found that around 70% of dentists work in a general private practice, while only 4% work in a public health practice. The lack of dentists in public health limits accessibility to dental care. Many private practices do not accept Medicaid.

With an aging population and declining interest in healthcare professions among younger generations, the dental care shortage is worsening. The same Workforce survey found that a mere 4.7% of dentists are 20-29 years old, and the extensive process of becoming licensed as a dentist in the United States is scaring university students away.

On average, students require six to eight years before they are able to practice in Florida, excluding any specialization licenses.

Increases in costs of living due to post-COVID inflation have caused many to avoid taking out massive loans needed to afford dental school, since these costs can range from $100,000 to a whopping $400,000.

Florida needs more accessible licensing pathways. According to the American Dental Association (ADA), a dental hygienist is responsible for performing preventive care, such as teeth cleanings, oral health assessments, and providing guidance on maintaining oral hygiene, which supports the work of dentists but does not involve advanced or invasive procedures. Additionally, a dental hygienist needs a license to apply anesthesia, strangling even more the supply of professionals.

However, the current licensure process requires candidates to have graduated from an ADA-accredited dental hygiene program or an unaccredited dental program with equivalent training. Additionally, a dental hygienist needs a license to apply anesthesia, which they rarely if ever apply directly, limiting even more the supply of professionals.

Applicants must pass multiple examinations, including the National Board Dental Hygiene Examination, ADEX Dental Hygiene Licensing Examination, and Florida Laws and Rules Examination. They are also required to submit numerous documents, such as official transcripts, certification of licensure, and even proof of CPR and AED training.

The licensing problem is even more bizarre for immigrants wth foreign licenses as their license is worthless regardless of their experience and practice as a dentist. Foreign dentists must start their studies from zero and enroll in dental school.

Moreover, Florida public dental schools, such as the University of Florida (UF) require applicants to be permanent residents. Excessive lawyer fees and a lengthy process mean foreign dentists must wait at least seven years to be able to apply to dental school. Affordability and complexity push away skilled workers looking to serve the American population.

Florida is facing a dental care crisis, and reducing unnecessary barriers for individuals entering dentistry, particularly for immigrants with foreign dental training, would help address this shortage.

Loosening these restrictions to allow competent and talented dentists and hygienists into the field would reduce wait times for patients and ensure that preventive dental care is accessible to more communities in need.

A change of this magnitude would serve as an example for reform in other fields in need, such as general health care and even education. The overarching issue of the labor shortage and gap is not being given the required attention from politicians, and even those running for the highest ranks in the US.

June 6, 2025Gabriel Carraro de Andrade

House passes bill cutting permitting red tape; next stop, Senate floor

via: floridapolitics.com

Builders and homeowners often get exasperated by delays — waiting costs time and money.

Good news might be coming soon for people in Florida who build houses or need home repairs.

A new proposed law (HB 683) aims to make the process of getting building permits for smaller jobs faster and easier. On Friday, the House passed it unanimously, 114-0.

Read the entire story on Floridapolitics.com

April 28, 2025

What can the Tallahassee Airport learn from the Coastal Carolina Chanticleers?

In addition to having one of the greatest nicknames in all of sports – the Chanticleers – Coastal Carolina University knows how to market and drive attendance.

The Conway, S.C., Division 1 football team had a decent 2024 (6-7 record) with decent attendance, averaging 17,128 in a stadium of 20,000. Season tickets average around $200.[…]

April 10, 2025What can the Tallahassee Airport learn from the Coastal Carolina Chanticleers?

Here is a hint: You won’t have to pass “Go!”

In addition to having one of the greatest nicknames in all of sports – the Chanticleers – Coastal Carolina University knows how to market and drive attendance.

The Conway, S.C., Division 1 football team had a decent 2024 (6-7 record) with decent attendance, averaging 17,128 in a stadium of 20,000. Season tickets average around $200.

But that didn’t stop Coastal Carolina Athletic Director Chance Miller from being bold. He announced that all concessions at Coastal Carolina football games will be FREE (excluding alcohol, of course). Hot dogs, soft drinks, pretzels – all free for ticket buyers.

Miller is throwing an estimated $250,000 a game down the drain, but what a great investment! Think of the goodwill, the increased ticket sales and the brand boost for the program. It’s a move that will create positive momentum and loyalty to the Chanticleers (which is a fierce rooster, by the way).

Now, you probably know where this is headed.

Tallahassee has long fought what is called “leakage” — in-market travelers who drive to Jacksonville, Atlanta or even Orlando to save money. They do this because the Tallahassee airport’s fares are the highest in the nation.

Sometimes the financial calculations can be tricky – a $100 difference for a single traveler might not be worth the trouble and added expense of gas, parking, and time.

But if a family of 4 is saving $250 per passenger, that’s a thousand bucks and mom and dad would probably spend some time on I-10 to save that kind of cash.

In the middle of those two, it can be a close call, balancing finances, convenience and time.

The big idea:

What if Tallahassee’s airport decided to make that call a little harder by going to free parking? The short-term lot costs $15 for a full day; $13 for long term. For a 7-day vacation that’s around $100 of savings that could be offered to travelers. For some, it might be enough to make a difference.

Another idea: How about free coffee at the airport, especially for the plague of pre-dawn flights that seem to be the only options to travel out of town? Sure, there are existing contracts, etc. but why is Tallahassee making its lightly traveled airport a profit center instead of finding ways to make it attractive for residents? Put another way, if Coastal Carolina can give away free food and drinks to their football fans, can’t Tallahassee figure it out for its travelers?

We’ve talked about downtown Thomasville, Georgia’s allure – how much do you pay for parking there? Zilch.

Time for new leadership?

There is also the issue of governance. The Greater Tallahassee Chamber has, in the past, sought to move the airport to an “authority” as exists in other Florida communities. While we certainly aren’t in favor of change for change’s sake, can the performance of the airport really get any worse under a new structure?

We can’t find a single commercial airport in Florida that hasn’t seen passenger traffic growth in the last 30 years, which would make TLH dead last in growth. That alone should be cause for a new model.

One thing to keep an eye on is the state of Florida deciding to take control of the airport. It is certainly a nuclear option, but the airport of a capital city is a vital link in the state’s economic development efforts.

Changing the mindset

Back to the spirit of the Chanticleers, there is good evidence that Tallahassee leaders are thinking innovatively. The City of Tallahassee recently announced a new exhibit at the airport touting the National High Magnetic Laboratory at Florida State.

Even though that’s an idea that has, ahem, been around since at least 2017, it’s a good one.

One last point: Surely it’s just a matter of time before someone loses their life driving for hours to fly out of a cheaper airport. Our current setup is unsafe, not good for the environment and not respectful of city residents. It’s time for some truly innovative thinking to turn this airport around.

So, raise a glass of coffee – or the arm of a parking garage barricade – to the Chanticleers and their innovative approach to customer relations.

April 10, 20251994 in TLH: Governor Chiles, ‘Choak at Doak’ and … the same amount of airport traffic

While TLH fares are highest in the land; traffic has stalled

In 1994, the Tallahassee Airport celebrated a major milestone – more than 1 million passengers flew out of TLH.

In the more than 30 years since then, growth in other Florida airports has been rapid.

Palm Beach Airport passenger traffic has grown 50 percent. Ft. Myers has almost tripled. Nearby Jacksonville up 38 percent. In fact, along with Pensacola, Jacksonville was recently rated one of the fastest growing airports in America.

And another state capital airport, in Austin, Texas, opened in 1999 with 6.6 million passengers – in 2024 that number tripled to more than 21 million.

So, how about TLH in the past 30 years?

Traffic has actually dropped. That’s right, there are fewer people flying in and out of Tallahassee than there was when Lawton Chiles was governor. The Tallahassee airport had about the same number of travelers the year of The Choke at Doak (FSU’s comeback from 31-3 vs. UF) as it did in 2024.

According to the Office of Economic Vitality, while 1.06 million passengers flew in and out of TLH in 1995, that number was just 968,000 in 2024.

Those JetBlue blues

It’s not for lack of trying. Efforts to attract new carriers and new routes have led to brief interludes with JetBlue and other airlines. Various marketing campaigns have attempted to stem the tide of in-market travelers choosing to fly out of Jacksonville, Atlanta or Orlando (called “leakage” in the industry).

And there have been failed deals to develop the airport, including a much-ballyhooed $616 million deal with North American Aerospace Industries that was the subject of celebratory party and claims by Mayor John Dailey that it would be a “gamechanger” (two months before his narrow primary election win over Kristin Dozier) before it eventually fizzled.

Other improvements to the airport have been frequent and expensive:

- In 2015, more than $10 million was spent on a terminal redesign.

- In 2021, another $4.5 million was spent on improvement to the concourses.

- In 2022, an international processing facility was constructed, at a cost of $28 million, with the promise that it would create 1,600 jobs.

- In 2023, the City allocated another $1 million to airport renovations.

Oh, and about those fares

Another thing that has kept Tallahassee passenger traffic low is high fares. Presumably because of limited supply, TLH fares were recently found to be the highest in the entire U.S. The analysis found that the average fare out of TLH is a whopping $562.

One theory, in media reports, is that the willingness of Tallahassee’s political class to fly at the last minute means airlines hold fares higher.

A larger issue is the lack of competition and the lack of growth in the market, as evidenced by this recent Red Tape Florida report.

Sandbagging gets new meaning

But then there are questions of service, coordination with federal partners, communication and more.

Complaints about airport service are legendary in Tallahassee.

To wit, the week of March 22 was not a good one for TLH as multiple issues surfaced.

On March 22, passengers on an American flight to Miami spent an hour on their plane before being taken off en masse and then reboarding again less than an hour later. As one passenger posted on X, “According to our pilot, there is no maintenance crew here to sign off on the flight log.” Another asserted that the maintenance contractor lived 45 minutes away.

Red Tape Florida reached out to Airport Director David Pollard for clarification on this, but he has not responded.

That same day, an American flight to Charlotte was delayed 4 hours which meant two flights to Charlotte left at roughly the same time from two separate gates. Red Tape Florida’s Skip Foster witnessed a passenger end up trying to board the wrong Charlotte flight – after his actual flight had already left.

It was also noted that employees wearing the same work garb as baggage handlers were serving as gate agents and were boarding flights.

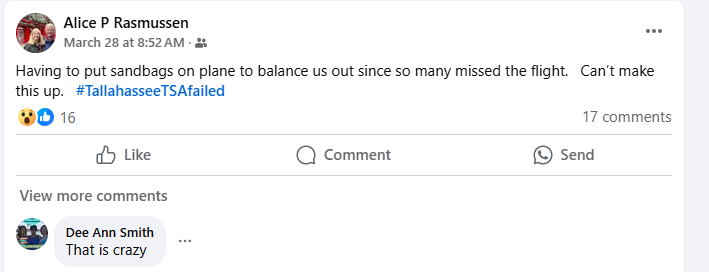

Then, on March 28, both TSA scanners apparently malfunctioned at the same time, resulting in hand-wanding of passengers.

This caused so many to miss their flights that, as one passenger posted on Facebook, the pilot had to order sandbags added to the plane to get the balance correct.

Thankfully, the flight arrived safely.

Always soaring: Bureaucracy

Meanwhile, even though passenger traffic isn’t growing, the airport bureaucracy is.

Just since 2010 (so, for half of the 30-year span of growth-less-ness at the airport), the airport budget has grown more than 50 percent to just under $20 million. More than $4 million of that is for salaries and overtime.

The current budget increased more than 16 percent over prior year. City of Tallahassee budget numbers are not available online for 1995.

COMING LATER THIS WEEK: Red Tape Florida offers a few suggestions for changing the game at TLH.

April 8, 2025

ADVOCACY: Ormond Beach’s NIMBY victims: jobs, affordable housing, public trust … and common sense

Let’s state this clearly up front:

The City of Ormond Beach is on a course to spend tens of millions of taxpayer dollars fighting a perfectly legal new home development on behalf of a handful of nearby homeowners who are weaponizing local government to deny someone their property rights.[…]

April 3, 2025Skip Foster, Red Tape Florida

ADVOCACY: Ormond Beach’s NIMBY victims: jobs, affordable housing, public trust … and common sense

Let’s state this clearly up front:

The City of Ormond Beach is on a course to spend tens of millions of taxpayer dollars fighting a perfectly legal new home development on behalf of a handful of nearby homeowners who are weaponizing local government to deny someone their property rights.

The casualties of this futile battle are: local jobs, affordable housing, smart development, public trust, taxpayer dollars and common sense (more on all of these shortly).

A Red Tape Florida investigation detailed the situation earlier this week. The short version: A property owner wants to develop a defunct golf course into homes that will fit well within the current neighborhood, but the city is denying them any kind of zoning. A federal lawsuit has been filed after the homebuilder exhausted all efforts.

That this type of anti-free market activity is happening in a bright red county is quite breathtaking.

This is not a simple difference of opinion, by the way. As the homebuilder’s legal team has unearthed, the city is simply not operating in good faith on this matter. They are starting with “how do we deny this” and then trying to find (or manufacture) a rule to support their desired final outcome.

That leads to email correspondence such as the planning department admitting to the city attorney: “(we) cannot find another city that has assigned a Planned Development with no development order.” The city attorney’s response is, essentially, don’t worry about it.

If you’re reaction to this is to shrug, then let us offer some dominos that might affect others in Ormond Beach and around the state.

Domino No. 1: The impact on blue collar workers. These 300 or so homes would all need roofers, plumbers, electricians, landscapers, painters, cabinet makers, dry wall installers, irrigation experts, graders and countless other tradespeople. This is work that is being withheld from them by the government and neighbors who don’t actually own the land in question.

Domino No. 2: Affordable housing. What’s particularly insidious about this weaponization of local government by NIMBY neighbors is the attempt to strong-arm the developer into building houses that are LESS affordable (presumably because the nearby homeowners don’t want to associate with any riffraff). It’s embarrassing and insulting.

Domino No. 3: Erosion of public trust. Ormond Beach is going to lose this lawsuit and be forced to do what is clearly their legal obligation. Then what will happen to the millions in legal fees the city must pay? Answer: Of course, it will be just absorbed into the massive bureaucracy that is local government. And remember, the city could also be on the hook for tens of millions in punitive damages for the lose of use of the property – perhaps even as high as $40 million. That’s a disaster for Ormond Beach taxpayers.

Domino No. 4: The loss of revenue to local government from higher property values – revenue that could help lower taxes or provide vital services to residents.

By the way, there was an easy solution here: The 500 homeowners could have bought the land in 2018 for the same purchase price, and it would have been just about $5,200 each. If financed, as a group, the monthly payments would have been manageable.

Instead, ALL Ormond Beach taxpayers are on the hook for a lawsuit that could cost many times the value of the property in question.

It’s time for Ormond Beach taxpayers to demand an end to this. The developer has already shown a willingness to compromise, adding greenspace, buffers and more to his proposal.

The city needs to show some leadership and look out for all of its taxpaying residents by coming to the table and working out a solution.

April 3, 2025Skip Foster, Red Tape Florida