A win is a win, but let’s not Breeze past context and history

Tallahassee International Airport is adding two new nonstop routes on Breeze Airways — Fort Lauderdale and Raleigh-Durham. […]

February 26, 2026By Skip Foster, Red Tape Florida

A win is a win, but let’s not Breeze past context and history

By Skip Foster, Red Tape Florida

Tallahassee International Airport is adding two new nonstop routes on Breeze Airways — Fort Lauderdale and Raleigh-Durham.

That’s really good news.

Full stop.

More destinations are better than fewer. And increased supply ought to eventually drive down price.

It wasn’t free – $3 million in Tallahassee taxpayer money is headed to Breeze as a part of the deal. But with a limited number of $39 introductory one-way fares, that’s a pill that many residents will find easier to swallow.

Now, let’s look at this development from cruising altitude and compare the new Breeze world to where TLH stood before Silver Airways shut down and JetBlue ended its brief Tallahassee flirtation.

The Silver/JetBlue baseline

Before Silver ceased operations in 2025, its Tallahassee network consisted of two nonstop destinations at its recent peak:

• Fort Lauderdale

• Tampa

Fort Lauderdale was the last route standing when Silver collapsed. Tampa had already been discontinued.

JetBlue’s Tallahassee experiment was brief. The airline launched daily nonstop service between TLH and Fort Lauderdale on January 4, 2024, then announced it was pulling out less than a year later, with its final Tallahassee departure on October 27, 2024.

What Breeze restores

The new Fort Lauderdale service restores that lost South Florida connection.

The Raleigh-Durham route is new.

Raleigh-Durham International Airport serves the Research Triangle region and offers strong domestic connectivity. It is not a legacy airline hub, and Breeze operates as a point-to-point carrier rather than a traditional hub-and-spoke airline, but Raleigh does expand geographic reach beyond Florida.

What this does not do

It does not restore Tampa service.

It does not dramatically increase frequency. Both Breeze routes are scheduled three times per week. That provides options, but not daily flexibility.

What it does do

It brings the airport back to roughly the same number of nonstop destinations Silver offered at its recent peak — but with a different mix.

Instead of Fort Lauderdale and Tampa, the lineup becomes Fort Lauderdale and Raleigh-Durham.

That’s likely a trade up. Tampa functioned largely as a Florida destination. Raleigh-Durham, by contrast, offers broader connectivity across the eastern seaboard — though Breeze itself operates primarily point-to-point.

The incentive reality

Airports across the country routinely offer incentives — fee waivers, marketing support, or revenue guarantees — to attract new service. Tallahassee is no different. That’s not unusual; it’s standard industry practice.

The real test is whether the routes remain once incentive periods end and the flights have to stand on their own economics. TLH’s track record with incentive-backed carriers is mixed. JetBlue’s brief run is a reminder that incentives can launch service — but they don’t guarantee permanence. Hopefully, Breeze will stick.

The bottom line

This is a solid development for TLH. The city regains a South Florida nonstop and gains access to a growing North Carolina market. It essentially returns TLH to the place it was earlier this decade

It does feel a bit like Tallahassee’s current restaurant scene, however – one opens; another closes.

Until Tallahassee experiences real population growth and economic development expansion, the calculus is unlikely to change.

February 26, 2026By Skip Foster, Red Tape Florida

Leon County runs at revenue — not recognition

By Skip Foster, Red Tape Florida

Leon County wants to send a delegation to Europe to pursue something ambitious: making Apalachee Regional Park the permanent home of the World Athletics Cross Country Championships.

Let’s start here: fiscal skepticism is healthy. We appreciate it. Taxpayer dollars deserve scrutiny.

But there is a time to pinch pennies — and there is a time to press an advantage.

This looks like the latter.

Leon County just hosted the 2026 World Athletics Cross Country Championships — the first time the event returned to the United States since 1992. Nearly 500 athletes from 52 countries competed at Apalachee Regional Park. More than 10,000 spectators attended. Broadcast coverage reached over 70 nations.

Preliminary projections presented to the Board estimate more than $4 million in direct economic impact.

Notice what that number is not.

It’s not $40 million. It’s not $75 million. It’s not padded with imaginary multipliers and “lifetime branding value.”

It’s a grounded, realistic number. And that makes it more credible.

If anything, given the attendance and international exposure, it may prove conservative when final numbers come in.

More importantly, this wasn’t a one-off experiment. Apalachee Regional Park has already generated $84 million in direct spending since 2013 through repeat championships and national events. The infrastructure is built. The course is proven. World Athletics President Sebastian Coe publicly called it “the best cross-country course in the world.”

That is leverage.

And leverage is something you use.

The travel being requested is not junketing. It is business development. It is follow-through. It is relationship management at the highest level of an international governing body that controls where future championships are awarded. And there is a chance a deal can be reached even without the travel.

But, if Leon County believes it can position ARP as the permanent home of this event — the way Omaha became synonymous with the College World Series and Williamsport with the Little League World Series — then this is exactly the moment to lean in.

The travel cost is estimated to be less than $20,000 and would come from bed tax dollars, not property tax revenue.

This is what those dollars are for.

Commissioner Rick Minor was the lone “no” vote on authorizing travel for the Chairman to join staff in upcoming in-person meetings with World Athletics leadership. Minor’s fiscal responsibility is laudable, but he appears to have missed the big picture of investing in a pitch to secure a strong return.

The County’s visionary approach is in stark contrast with other local approaches to “recognition.” The City of Tallahassee spent roughly $150,000 pursuing All-America City designation — a program that may bring civic pride and a nice plaque, but does not generate recurring tourism revenue, hotel nights, or international broadcast exposure.

There is nothing inherently wrong with civic awards. But let’s be honest about the difference.

One strategy produces a press release.

The other can produce repeat economic activity.

One is about recognition.

The other is about recurring business.

Leon County, under the leadership of County Manager Vince Long and his team, took a former landfill and turned it into one of the most respected cross-country venues in the world. That didn’t happen by accident. It happened through long-term investment and strategic follow-through.

Trying to lock in permanent-host status is not reckless. It is a calculated extension of a proven success.

There is always room for debate about travel. There is always room for caution.

But when you have momentum, international praise, realistic financial projections, and a tourism funding source designed for exactly this purpose — this is not the time to step back.

It’s time to run through the tape.

February 20, 2026By Skip Foster, Red Tape Florida

The shout: GDP grew! The whisper: It was mostly rent and government

The Office of Economic Vitality wants you to know that Tallahassee outpaced Florida and the nation in GDP growth last year. […]

February 16, 2026By Skip Foster, Red Tape Florida

The shout: GDP grew! The whisper: It was mostly rent and government

By Skip Foster, Red Tape Florida

The Office of Economic Vitality wants you to know that Tallahassee outpaced Florida and the nation in GDP growth last year.

That’s true.

The Tallahassee metro grew 4.3 percent in real, inflation-adjusted terms in 2024.

“GDP is one of the clearest indicators of overall economic activity,” OEV Director Keith Bowers said in yet another pro-OEV email sent via the City of Tallahassee’s email list.

But here’s the harder question:

If GDP rises and jobs don’t, which is actually the clearer indicator?

Because when you open the data — not the press release — the story looks less like “momentum” and more like something very Tallahassee.

Leon County accounts for nearly 88 percent of metro GDP. Leon alone grew 4.7 percent in 2024.

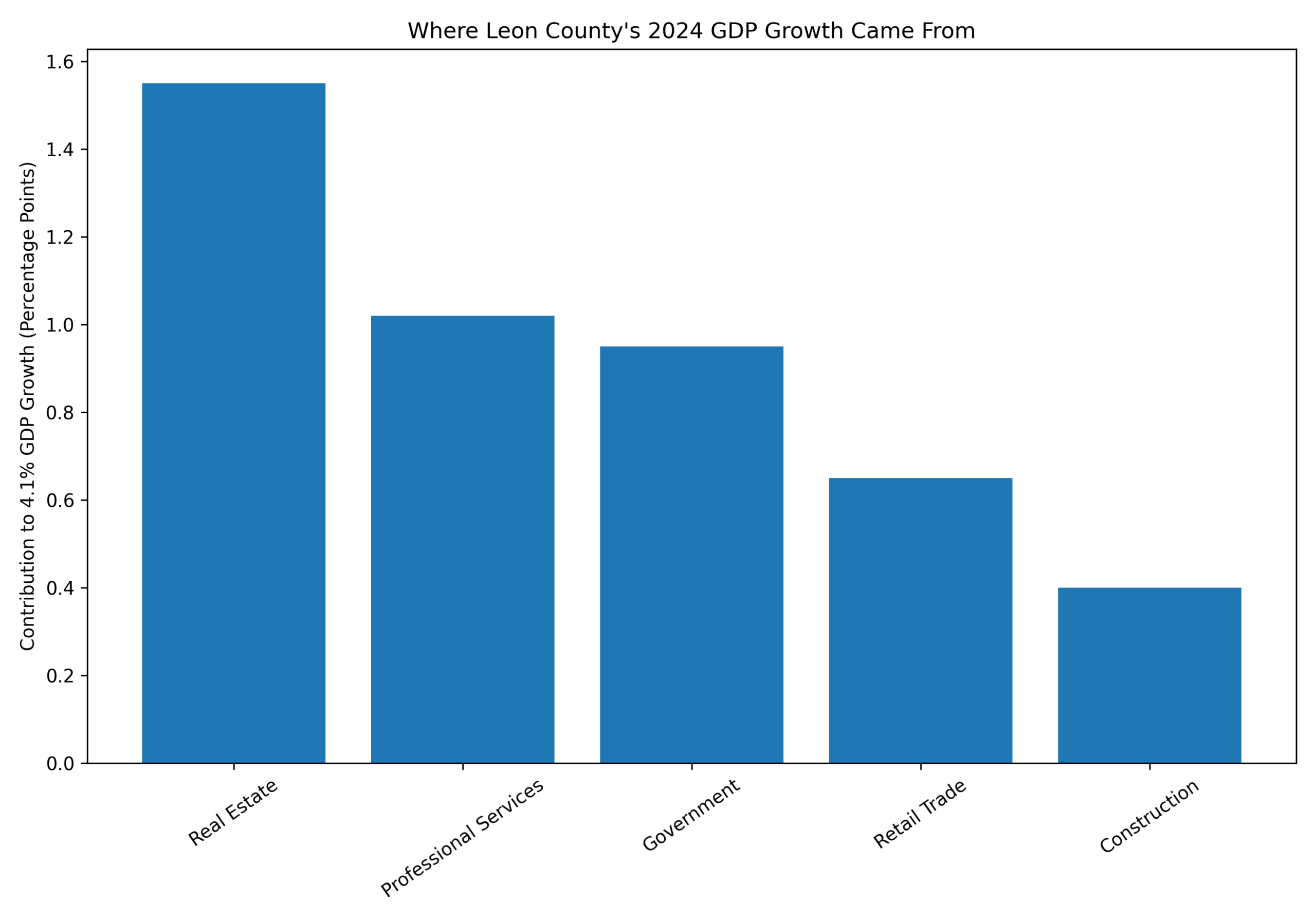

And when you break that 4.7 percent apart, three sectors drove most of it:

- Real estate and rental and leasing

- Professional, scientific, and technical services

- Government

Yet manufacturing declined sharply in real terms. In fact, while overall GDP rose 4.7 percent in 2024, Leon County’s manufacturing sector contracted by roughly 20 percent in real terms — a stark divergence from the growth narrative.

(Readers can drill down into the data themselves, here)

This was not broad-based industrial expansion.

It was concentrated growth in property, services, and government.

The rent year

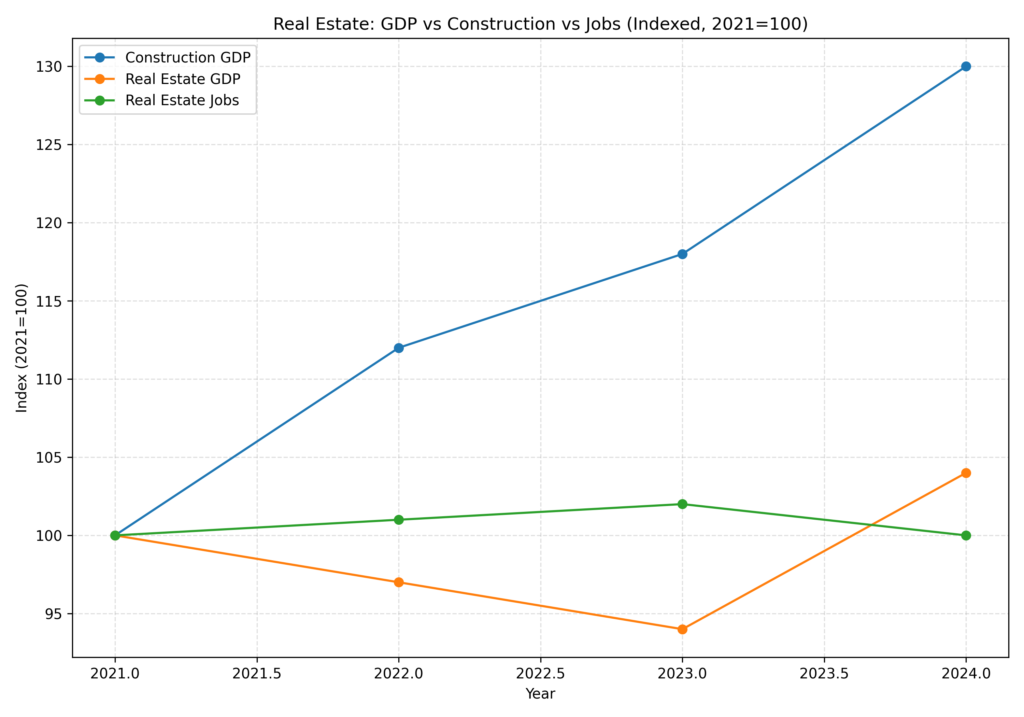

Real estate and rental and leasing rose roughly 11 percent in 2024 — about $275 million in real value added.

That single sector accounted for roughly one-third of Leon County’s GDP growth.

Now here’s what didn’t happen:

- Real estate jobs did not surge. In fact, employment actually declined slightly.

- Total payroll barely moved.

GDP up 11 percent.

Jobs down.

That’s not a hiring boom.

It’s rent.

The U.S. Bureau of Economic Analysis’ real estate category measures value added from owning, renting, and managing property. It includes rental income and imputed housing services. It does not measure housing starts.

Construction rose in 2024 — but by a fraction of the real estate increase.

In a college town dominated by high-end student housing, this pattern makes sense.

When new projects are delivered and lease up at premium rents, net operating income rises. GDP rises with it.

But rising property income is not the same thing as expanding the economic base. If GDP growth is being driven primarily by higher luxury student housing rents in a college town, that deserves explanation — not just celebration.

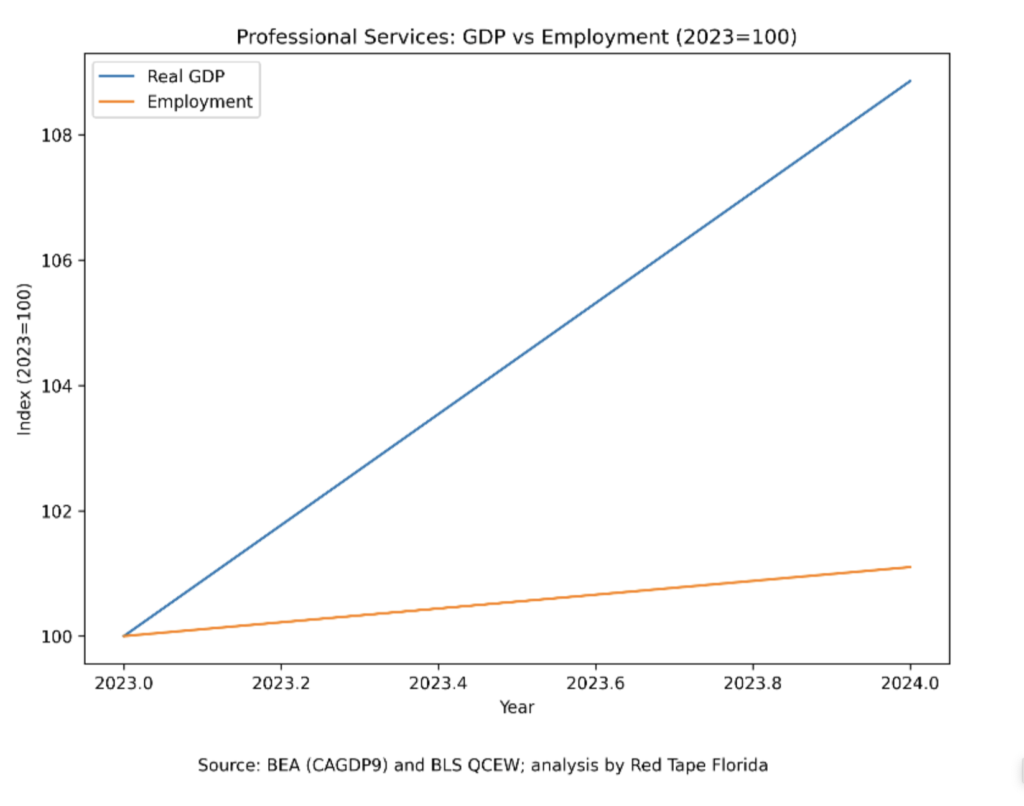

Productivity, not hiring

Professional, scientific, and technical services rose nearly 9 percent in real GDP — about $206 million.

That sounds like diversification.

But employment in the sector rose just 1.1 percent — 191 jobs.

GDP up almost 9 percent … headcount barely moved.

That means output per worker rose sharply.

Inside the sector, architectural and engineering services added jobs — likely tied to development and infrastructure work.

Computer systems design saw payroll jump sharply while employment stayed flat — a sign of higher contract value, not workforce expansion.

Scientific research and development services — where a dramatic university spillover would show up if one existed — grew modestly.

Again, this was more value generated by roughly the same number of people.

Which brings us back to OEV’s claim that GDP is the clearest indicator.

Is it?

The clearer indicator: jobs

In prior Red Tape Florida reporting, we’ve shown that Tallahassee’s job growth since 2023 has been flat to weak relative to peers. Employment gains have slowed materially. The region has struggled to generate sustained private-sector job expansion.

If GDP rises 4.7 percent and employment rises roughly 1 percent, then real GDP per job rises roughly 3–4 percent.

That means the economy produced more output per existing worker.

That is not nothing.

But it is not the same as:

- More residents employed.

- More families earning paychecks.

- A broader tax base.

- A more diversified private sector.

GDP measures value added.

Jobs measure participation.

If the goal is long-term economic vitality, job growth is often the more direct indicator of whether an economy is expanding its base.

A year where real estate value added rises, professional services bill more per worker, government grows steadily, and manufacturing contracts is not a transformational year.

There is one more structural piece of this story that cannot be ignored.

And, of course, government growth drove GDP

One other major contributor to 2024 GDP growth deserves attention: government.

Real (inflation-adjusted) government value added in Leon County rose roughly 3.75 percent in 2024 — an increase of about $169 million in real terms, according to BEA’s county GDP data.

That makes government one of the top three contributors to overall GDP growth last year.

And here’s the critical point:

GDP counts government output the same way it counts private-sector output.

If public payroll rises, if state agencies expand operations, if public enterprises generate more activity … GDP rises.

That’s how the metric works.

But in a state-capital economy like Tallahassee, that distinction matters.

Growth driven by:

- Property income,

- higher billings in professional services,

- and government value added …

… is structurally different from growth driven by new export industries, manufacturing expansion, or sustained private-sector hiring.

In prior Red Tape Florida reporting, we’ve shown that job growth has slowed materially since 2023 and that private-sector expansion has been uneven at best.

Against that backdrop, a year where government and property are major drivers of GDP growth doesn’t signal diversification.

It signals reinforcement of the existing model.

That may produce a strong headline.

But it’s not the same thing as economic transformation.

The bottom line

The ranking doesn’t change the structure

Yes, Tallahassee ranked near the top of Florida metros in 2024 GDP growth. But ranking doesn’t change composition.

The 4.3 percent headline is accurate. But the clearer indicator of where Tallahassee stands may not be GDP. It may be job growth.

We don’t blame OEV for highlighting positive metrics. But rankings and selective statistics can’t change the underlying reality:

- Out-of-town prospects describe a bureaucratic process that caused them to take their business elsewhere.

And, as we’ve said before, the performance is much more about a flawed structure, than poor leadership or performance.

All the rankings and stats and the world can’t change the fact that Tallahassee is not seeing growth in manufacturing, new business and jobs.

The best that can be extrapolated from GDP numbers touted by OEV is that In 2024, Tallahassee had a strong year for asset income, higher billings and the growth of government.

That is optimization.

Transformation looks different.

Until job growth reflects it, GDP alone is not the clearest indicator.

February 16, 2026By Skip Foster, Red Tape Florida

Tallahassee’s economy: ‘Momentum’ or spin

When governments are proud of their economic performance, they show residents jobs. When they’re not, they show rankings.[…]

February 5, 2026By Skip Foster, Red Tape Florida

Tallahassee’s economy: ‘Momentum’ or spin

By Skip Foster, Red Tape Florida

When governments are proud of their economic performance, they show residents jobs.

When they’re not, they show rankings.

That’s the only way to understand the City of Tallahassee Office of Economic Vitality’s Feb. 4 communiqué declaring that Tallahassee-Leon County’s economy is “building momentum” and that “the numbers show it.”

The OEV narrative that follows is not a serious economic analysis. It is a carefully assembled propaganda piece designed to distract from a stubborn and embarrassing reality: by OEV’s own data, Tallahassee is not growing — it is stagnating, and in some cases going backward.

Start with the rankings — because that’s where the deception begins.

OEV leads with a glowing national ranking from Area Development magazine, breathlessly announcing that Tallahassee-Leon County placed 16th overall among nearly 1,000metropolitan and micropolitan areas. That sounds impressive until you understand what this ranking actually rewards.

Area Development’s index is a blended soup of more than two dozen indicators, many of which favor government-heavy economies, long-term averages, and institutional stability. Tallahassee’s enormous state-government footprint, universities, and healthcare systems prop up these scores even when private-sector job creation is anemic.

In plain English: Tallahassee ranks well because it is stable — not because it is growing.

That distinction is not an accident. It is the entire point of using rankings instead of outcomes.

Next comes the “workforce strength” sleight of hand.

OEV touts a top-20 national ranking for “Prime Workforce” performance, citing wage growth, labor-force trends, and STEM employment shares. What the release never explains is where these jobs are actually coming from.

Much of Tallahassee’s wage growth mirrors national inflation and public-sector pay adjustments, not a competitive private market. Meanwhile, counting the share of STEM workers is meaningless when the region continues to struggle to attract the private employers who would hire them. A “strong workforce” that must leave town to thrive is not a strength — it’s a failure.

Then comes perhaps the most unintentionally revealing boast of all.

OEV proudly notes that roughly one-third of workers employed in Tallahassee-Leon County commute in from surrounding counties, framing this as evidence that Tallahassee is a powerful regional employment hub. In reality, this is not a flex. It’s a flashing warning light.

While growing a regional economy is a laudable goal, high inbound commuting often signals that the core city is failing to generate enough well-paid resident workers to support household formation and long-term wealth creation. Tallahassee captures labor during the day and exports wages, homeownership, and tax base at night.

The American Planning Association’s PAS Report on jobs–housing balance explains that when communities have a persistent mismatch between where jobs are and where workers can afford to live, the result is longer commutes and higher household transportation costs — and those costs can erase or outweigh wage gains, while also increasing regional congestion and infrastructure burdens

A thriving economy retains its workers. It doesn’t rent them.

But the most glaring omission in OEV’s entire release is the one statistic it absolutely refuses to confront: its own jobs data, as revealed in a recent Red Tape Florida story.

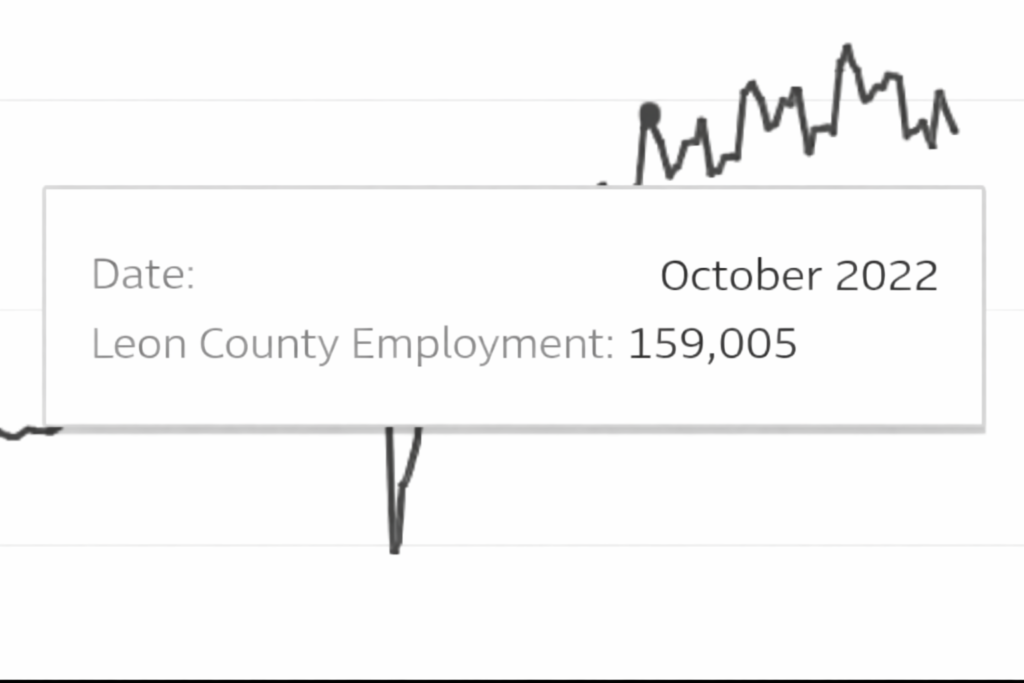

According to OEV’s own employment chart, Leon County had roughly 159,000 jobs in late 2022. By late 2025, that number had fallen to about 158,000. That is not momentum. That is net job loss — quietly buried beneath glossy language and national rankings.

To paper over this failure, OEV resorts to one of the oldest tricks in the economic-development spin book: anchoring job growth to April 2020, when pandemic shutdowns collapsed employment. Starting from the bottom of a once-in-a-century economic shutdown allows almost any community to claim dramatic “growth.”

Recovery is not success. Rebounding is not momentum. And Tallahassee’s post-pandemic performance remains weak even by that generous standard.

The Florida Chamber of Commerce, using the same federal data OEV selectively cites, reported that Leon County lost more than 4,000 jobs year-over-year — a fact OEV dismisses because it is inconvenient, not because it is wrong.

And here’s the most telling detail of all: in 2025, OEV did not announce a single new economic-development project that added jobs. Not one. No relocations. No expansions. No headline wins. Just rankings, rankings, rankings.

The release closes with optimism about real-estate “prospects,” citing a national perception survey showing improved sentiment among investors. Sentiment, however, does not build office space. Surveys do not sign paychecks. And optimism does not create private-sector jobs.

Perhaps Tallahassee-Leon’s job numbers would be better if OEV spent less time on self-congratulatory rankings report and more time on actually recruiting new business to our community.

Tallahassee residents do not live inside rankings.

They live inside paychecks. Inside housing costs. Inside career ceilings. Inside a local economy that has spent years confusing institutional stability with economic success.

Until the city is willing to show honest, current job numbers — without pandemic baselines, without composite rankings, and without propaganda — talk of “momentum” is not analysis.

It’s marketing. And it’s insulting.

February 5, 2026By Skip Foster, Red Tape Florida

How OEV, Tallahassee use bad math to avoid facing a dreadful job-growth record

In 2021, Mayor John Dailey embraced Chamber-style scorecards as proof that Tallahassee was “making strong progress.” Five years later, with the numbers no longer flattering, local leaders are defending something else entirely: an economic narrative that only works if you start counting at the depths of the COVID shutdown and ignore what local government’s own data shows now. […]

January 23, 2026By Skip Foster

How OEV, Tallahassee use bad math to avoid facing a dreadful job-growth record

By Skip Foster

In 2021, Mayor John Dailey embraced Chamber-style scorecards as proof that Tallahassee was “making strong progress.” Five years later, with the numbers no longer flattering, local leaders are defending something else entirely: an economic narrative that only works if you start counting at the depths of the COVID shutdown and ignore what local government’s own data shows now.

That distinction matters. Because the city-and county-run Office of Economic Vitality isn’t simply offering a different interpretation of Leon County’s economy. It is claiming “job growth” by anchoring its story to the pandemic-driven employment collapse of spring 2020 — while simultaneously glossing over its own more recent jobs data showing that both the Tallahassee metro area and Leon County have fewer jobs today than they did just a few years ago.

With the Florida Chamber of Commerce reporting that Leon County lost more than 4,000 jobs year over year, local officials insist the data is misleading. But the more misleading move is how OEV is choosing its baselines and time windows — and how consistently that choice makes stagnation look like progress.

Lies, damn lies and … OEV statistics

For nearly a year, Red Tape Florida has focused on what actually constitutes economic development: new private-sector employers, new headquarters, and new payrolls that did not already exist here. Not projections. Not reclassifications. Not job churn inside government, hospitals, or universities. Not pie-in-the-sky economic impact projections.

By that standard, Leon County’s record has been abysmal. In 2025, the Office of Economic Vitality failed to announce a single new economic development project adding jobs. Zero. That fact alone should have prompted a serious reckoning.

Instead, OEV doubled down on narrative, claiming that the Florida Chamber stats were misleading. As it turns out, OEV was the one practicing subterfuge.

Look at OEV’s own Leon County–only employment chart. In October 2022, Leon County employment stood at roughly 159,000 jobs. By November 2025, employment had fallen to approximately 158,000. Yes, that‘s fewer jobs after three years.

That is not a disagreement over methodology. It is decline.

And then there’s the baseline trick which was the basis for OEV director Keith Bowers claiming a 25,000-job increase since 2020.

That “growth” appears only when OEV measures from April 2020, when employment collapsed during the COVID shutdown. Leon County employment plunged to roughly 127,800 jobs that month, as you can see from the plunge on OEV’s own graph. The Tallahassee MSA shows a similarly sharp trough. Measuring “growth” from that moment is not economic development or job growth. It is recovery from a once-in-a-century emergency.

Every community in Florida looks like a success story if you start counting at the bottom of the pandemic crater. Serious analysts do not treat April 2020 as a neutral baseline without heavy caveats. OEV does it anyway — and then quietly ignores the fact that job counts have been anemic in the years since.

Put plainly, OEV is doing two things at once: using the COVID collapse to inflate long-term “growth” claims, while ignoring its own short- and medium-term data showing job losses. That is not optimism. It is selective storytelling.

Even in the best case, job growth lags

Strip away the cherry-picking, and the broader picture becomes unavoidable. Even under OEV’s preferred data, Leon County is underperforming the state. Florida has added jobs, population, and private-sector investment at a pace Tallahassee is not matching. Peer counties are moving forward. Leon County is treading water — and now drifting backward.

Right BEFORE the pandemic, Leon County reported having 152,456 jobs, which means the county has added an anemic 5,500 jobs in more than 5 years, less than 1 percent-per-year growth.

That’s simply an embarrassing record and a monument to weak local government leadership over the past 10 years – and longer.

The population numbers reinforce the same conclusion. Over the past decade, Leon County’s population has grown by just 4.4 percent, while Florida as a whole has surged ahead. At the same time, local government staffing has expanded dramatically. That is not the profile of a dynamic regional economy. It is the profile of a place where the public sector grows faster than the private one.

This is why the sudden impulse to discredit the Florida Chamber’s Scorecard rings hollow. It was the brainchild of widely respected Florida Chamber CEO Mark Wilson who, of course, has no reason to paint one county’s number is anything other than what they actually are.

The Scorecard itself isn’t new or unfamiliar. In fact, local leaders once treated Florida Chamber-style dashboards as a gold standard — so much so that the Tallahassee Chamber built its own Community Scorecard modeled after that framework. When those dashboards showed progress, City Hall was happy to cite them. Now that both state-level data and OEV’s own charts point in the wrong direction, the instinct is to litigate definitions instead of confronting outcomes.

Obfuscation and distraction: A pattern developing?

OEV’s response fits neatly into that pattern. Rather than acknowledging structural underperformance, OEV leans on technical explanations about commuting patterns, seasonal swings, and timing. None of that answers the question residents actually care about: where are the new jobs?

Hospitals hiring nurses is not economic development. Universities adjusting staffing is not economic development. Seasonal rebounds are not economic development. Economic development is additive. It shows up when new companies choose Tallahassee over somewhere else. On that score, the record is thin — and getting thinner.

As an aside, we would also point out that this is the second time in just a few days where local government has been caught being – to put it quite charitably – less than forthright about its actions. The recent CRA debacle, where the identity of a cannabis retailer was concealed, has the same foul aroma.

Massive leadership opportunity

The Tallahassee Chamber of Commerce, now under new leadership, has been notably cautious. “We’re aware of all the numbers,” Chamber officials say. Awareness is fine. Leadership requires clarity. When the Florida Chamber sets a target of more than 14,000 new jobs for Leon County by 2030, and the local pipeline bears no resemblance to that ambition, someone needs to say so plainly.

There is no shame in admitting that Leon County’s economic development strategy is not working. Regions stall. Models age. What matters is whether leaders are willing to confront reality and change course.

At this point, local elected officials — starting with former scorecard cheerleader Mayor Dailey, but including all city and county leaders — have a responsibility to reevaluate the structure, priorities, and accountability of the Office of Economic Vitality. Not as a personal critique of staff, but as a basic governance obligation. When even your own charts contradict your public talking points, the issue is no longer interpretation.

It’s credibility.

This story isn’t about which spreadsheet wins an argument.

It’s about whether Tallahassee is serious about growth.

And right now, denial is louder than the results.

January 23, 2026By Skip Foster

A bold vision to make TLH the region’s most convenient, passenger-friendly airport

At the Greater Tallahassee Chamber of Commerce annual breakfast this week, new Chair Eddie Gonzalez Loumiet delivered exactly the kind of message this community needs right now. Be bold. Be positive. Be innovative. Stop thinking small. […]

January 16, 2026Opinion by Skip Foster, Red Tape Florida

A bold vision to make TLH the region’s most convenient, passenger-friendly airport

Opinion by Skip Foster, Red Tape Florida

At the Greater Tallahassee Chamber of Commerce annual breakfast this week, new Chair Eddie Gonzalez Loumiet delivered exactly the kind of message this community needs right now. Be bold. Be positive. Be innovative. Stop thinking small.

That challenge applies across Tallahassee’s economy. But there may be no place where it applies more urgently — or more visibly — than Tallahassee International Airport.

For years, we’ve heard about “leakage”: residents and visitors driving to Jacksonville, Orlando, or other airports to save money or gain access to better flight options. We study it. We lament it. We pass subsidy programs meant to lure airlines.

And yet leakage persists.

Here’s the uncomfortable truth. You don’t beat leakage by pretending Tallahassee can out-Atlanta Atlanta or out-Orlando Orlando. You beat leakage by making flying out of Tallahassee so attractive and convenient that bypassing it feels irrational.

That requires a shift in mindset. Less airline-first. More passenger-first.

Start with the simplest, boldest move

Free parking at TLH

The city currently collects roughly $6 million a year in airport parking revenue, while simultaneously seeking subsidies to airlines in hopes of adding or retaining routes. In other words, we charge our own residents and visitors to fund incentives for someone else.

That’s backwards.

Free parking instantly lowers the cost and stress of choosing TLH. It sends a clear signal that Tallahassee values convenience and respects travelers’ time. It makes the local airport the default choice, not the one you talk yourself into after doing math.

Free parking shouldn’t be an incentive. It should be the baseline.

Move to all-local vendors

Every traveler has seen the tired airport gift shop — the same mugs, the same shirts, the same forgettable clutter.

TLH should do the opposite.

Why not intentionally recruit local businesses to fill those spaces, even if it means accepting lower rent or breaking even? Imagine browsing books from Midtown Reader before boarding. Coffee from Lucky Goat, Red Eye, or Ground Ops. Breakfast offerings from Canopy Road or Earley’s. Local brands, local pride, and local confidence.

The point isn’t maximizing concession revenue. It’s maximizing loyalty and identity. The airport is the first and last impression of a city. Right now, TLH doesn’t look like Tallahassee. It should.

Speaking of local vendors, the amount of local art that could be displayed at the airport is endless – it should be constantly rotating in and out.

Create a sense of urgency on behalf of customers

Fast retrieval of luggage should be the highest priority. Communicate to customers a target time for luggage delivery. Then, measure it. Then publish the results. Then work on maintaining good numbers and improving poor ones.

Add more generic EV charges

They are overallocated to Tesla’s, which are losing market share. No electric vehicle should ever be unable to charge while parking at TLH.

Lean into early mornings instead of ignoring them

Early morning departures are a fact of life at TLH. Instead of pretending otherwise, design around them.

Offer free local coffee for one hour — from 5:00 to 6:00 a.m. Partner with Tallahassee roasters. It’s inexpensive, humane, and unforgettable to anyone navigating the terminal half-awake.If somebody wants a fancy latte, they can pay for that, but a plain cup o’ joe is on the house.

Small gestures matter most when people are tired, stressed, and short on time.

Communicate like a service, not a press office

When flights are delayed by weather or TSA lines back up, travelers don’t just want information. They want clarity, reassurance, and honesty.

That means investing in communications as a core service.

Tallahassee should have an airport app that actually matters. Live parking availability. TSA wait times. Gate changes. Weather explanations in plain English. Push alerts when things change.

Many TLH flights leave very early in the morning. Design for that reality. Between 4:30 and 7:00 a.m., the app should default to a calm, simplified mode: gate confirmation, boarding countdown, coffee availability. No clutter. No guesswork.

And for those picking people up, offer a simple but transformative feature: text alerts for wheels-down, baggage carousel start, and passenger exit. Less circling. Less congestion. Less frustration.

Compete on care, not scale

Tallahassee will never win a volume contest with Orlando or a route contest with Atlanta. That’s fine.

What TLH can win is the experience contest.

It can be the easiest airport in Florida to use. The least stressful. The most honest. The one that respects your time and treats you like a neighbor, not a transaction.

And it’s not like it hasn’t been done before:

Portland built a national reputation by showcasing local businesses and requiring street pricing, and Jacksonville – one of TLH’s prime competitors — is rewarding travelers with free parking through a frequent parker program

Leakage doesn’t disappear because of one new route or one more subsidy vote. It disappears when enough people decide, again and again, that flying out of Tallahassee is simply the smartest, fastest and most pleasant option.

Eddie Gonzalez Loumiet challenged Tallahassee to be bold. Making TLH a truly passenger-first airport would be a great place to start.

January 16, 2026Opinion by Skip Foster, Red Tape Florida

CRA claims surprise over marijuana use — applicant’s homepage says “cannabis”

Tallahassee CRA officials, the day after Red Tape Florida reported on the issue, pulled a $750,000 grant request after acknowledging they could not support the project if the new building became a medical marijuana dispensary. […]

January 14, 2026By Skip Foster, Red Tape Florida

CRA claims surprise over marijuana use — applicant’s homepage says “cannabis”

By Skip Foster, Red Tape Florida

Let’s dispense with the fiction.

Tallahassee CRA officials, the day after Red Tape Florida reported on the issue, pulled a $750,000 grant request after acknowledging they could not support the project if the new building became a medical marijuana dispensary.

One problem: The applicant is a cannabis real estate company.

Not metaphorically. Not incidentally. Openly.

WeWould REIT describes itself on its homepage as a Florida-focused cannabis equity REIT, complete with a prominent image of a cannabis plant and multiple pages devoted to cannabis-specific investments.

WeWould REIT describes itself on its homepage as a Florida-focused cannabis equity REIT, complete with a prominent image of a cannabis plant and multiple pages devoted to cannabis-specific investments.

Yet the proposal advanced through the CRA process as a generic retail project — complete with a colorful building rendering labeled “food.”

According to Stephen Cox, the CRA’s executive director, the item was pulled only after staff concluded they could not recommend approval if the developer intended to lease the space to a dispensary. “We had a conversation with the owner, and he couldn’t guarantee that a dispensary wasn’t on the table,” Cox told the Tallahassee Democrat.

That explanation raises a far more basic problem than zoning or community preference. Either CRA staff knew they were advancing a grant application from a cannabis-focused real estate company, or they advanced a $750,000 public subsidy without performing even minimal due diligence. There is no third option.

This is the bureaucratic equivalent of telling a police officer that your friend said the bag he handed you was just home-grown oregano.

A quick tour of WeWould REIT’s own website makes the point unavoidable. Its homepage identifies the firm as a cannabis equity REIT. Its “Our Focus” page is devoted entirely to cannabis real estate. Its portfolio highlights properties acquired, developed, or leased for cannabis uses. Its “About Us” section frames the company’s mission around serving the cannabis industry and navigating its regulatory and capital challenges.

Cannabis is not a side possibility. Cannabis is the business.

This is the company CRA staff later said “couldn’t guarantee” a dispensary wouldn’t be part of the project.

Which raises a question that should concern every taxpayer in a CRA district.

What exactly is the threshold for due diligence?

Because this was not the product of in-depth investigative journalism. It did not require subpoenas, records requests, or forensic accounting. It required typing the applicant’s name into a browser.

Yet a 127-page grant application was assembled, packaged, placed on an agenda and nearly sent to a citizen advisory committee as a generic retail project, while the applicant’s core business model was treated as an afterthought.

Cox acknowledged that staff had previously discussed with the developer that a dispensary would “be looked negatively by the community” and that CRA staff “would not be able to give a recommendation for approval from the staff perspective” if that were the use.

In other words, CRA leadership understood that a marijuana dispensary was a live possibility — yet the proposal still moved forward without that issue being resolved or clearly disclosed.

CRA staff advanced a proposal framed as “retail,” showcased a rendering labeled “food,” and confined the only clear references to a medical marijuana dispensary to page 52 and page 114 of technical attachments.

Only after the Red Tape Florida story prompted resident calls did staff pull the item.

“We spoke with him and said, ‘Look, if you’re trying to do something like that, that’s definitely not going to fly,’” Cox said of the dispensary use. “You can still build it, but as far as assistance goes, that’s not going to be something that we would be in favor of.”

That may be true. But it is not reassuring.

If CRA staff did not know this was a cannabis real estate company, that is a failure of basic competence.

If they did know and chose to soft-pedal it in public materials, that is a failure of transparency.

Either way, the public deserves better than a shrug and a pulled agenda item.

That’s not redevelopment — just like it’s never oregano in the plastic bag.

January 14, 2026By Skip Foster, Red Tape Florida

The City of Tallahassee’s Year in Review: breaking down claims of 2025 success

By Skip Foster, Red Tape Florida

The City of Tallahassee’s 2025 Year in Review is glossy, upbeat, and brimming with accomplishments. It reads like a government that is busy, credentialed, and proud of itself.

In some respects, that pride is justified. In others, it’s doing a lot of work to distract from questions City Hall would rather not answer.

This is not a point-by-point rebuttal of every bullet in the document. Some things genuinely deserve credit. Others sound impressive until you ask the one question the Year in Review consistently avoids: compared to what?

Let’s start where credit is due.

Where the City actually earns it

Parks and quality of life

Tallahassee’s parks, tree canopy, and access to green space are real assets. They matter. They affect daily life. They are one of the few areas where Tallahassee truly punches above its weight. The City deserves credit for protecting and expanding them.

This is not spin. It’s substance.

Community programming

Senior Games participation, neighborhood events, and civic initiatives help explain why people like living here even when they’re frustrated with everything else. These programs aren’teconomic development and don’t need to be. They succeed on their own terms.

The problem begins when City Hall quietly slides from celebrating livability into declaring itself one of the best-run cities in Florida — as if the former automatically proves the latter.

Claims that do real rhetorical work — and deserve scrutiny

“Best-run city in Florida” and All-America City recognition

What the City says: Tallahassee was named a 2025 All-America City and ranked the best-run city in Florida.

What that actually means: The All-America City designation, awarded by the National Civic League, recognizes civic engagement and collaboration based largely on narrative applications. It does not measure wage growth, housing affordability, service speed, or economic outcomes.

The “best-run” label comes from a WalletHub ranking that compares the scope of services to budget per capita. Translation: cities with larger governments and larger budgets can score well even if residents feel nickel-and-dimed, stuck in process, or priced out.

What’s also true — and rarely mentioned: Through a public-records request, Red Tape Florida obtained documents showing that the City of Tallahassee spent approximately $130,000 preparing and submitting its All-America City application. That figure doesn’t even include staff time devoted to the effort — hours the City acknowledged were not tracked.

In other words, this was not a spontaneous external validation. It was a competitive, resource-intensive bid, funded by taxpayers, with no accounting of the full internal cost.

What’s missing:

— Any discussion of cost versus benefit

— Any disclosure of staff time diverted from core functions

— Any evidence that household fundamentals improved as a result

Awards feel less like independent validation when they come with a six-figure application budget and an uncounted amount of staff time.

Crime reduction

What the City says: Violent crime down 6.18 percent year-over-year and more than 30 percent over “the last couple of years.”

What that actually means: A favorable slice of time following a nationwide crime spike. Possibly real progress. Possibly regression to the mean. Impossible to tell from what’spresented.

What’s missing:

— Raw incident counts

— Population-adjusted rates

— Multi-year trends

— Neighborhood-level data

— Any comparison to similar Florida cities

If crime reduction is the crown jewel, show the jewels. Percentages without baselines are comfort food, not accountability.

Economic development and jobs

What the City says: More than 18,000 new jobs over five years. Conferences hosted. Awards received. Dashboards launched.

What that actually means: Five-year aggregates hide churn and allow for larger numbers. Fewer than 4,000 jobs added per year is also true and far less encouraging. Conferences and awards document activity, not employer wins. Dashboards document motion, not outcomes.

What’s missing (and this is the big one)

— Net new jobs by year

— Wage levels of new jobs

— Median household income trends

— Net migration of working-age residents

— A simple list of major relocations or expansions

This omission matters because prior Red Tape Florida reporting has already shown a consistent pattern: extensive economic-development storytelling paired with very few documented private-sector wins. The Year in Review does nothing to rebut that. It reinforces it.

If job growth were truly transformative, residents wouldn’t need to be told. They’d feel it in paychecks, rents, and opportunity.

Construction and capital spending

What the City says: More than $350 million in active construction projects.

What that actually means: The City spent money. Much of it public money. On things it already owns.

What’s missing:

— On-time and on-budget performance

— Change orders

— Long-term operating costs

— Private investment leveraged

— New taxable value created

Capital spending is not growth. It’s maintenance, replacement, and occasionally expansion. Treating dollar totals as success is a classic municipal tell.

Housing and permitting

What the City says: Permits or reviews issued for 548 affordable housing units.

What that actually means: Paper moved.

What’s missing

— Units actually built

— Units actually occupied

— Affordability levels and duration

— Public subsidy per unit

— End-to-end permitting timelines

— Comparison to peer cities

Red Tape Florida has documented repeatedly how time delays and layered reviews drive up costs. The Year in Review avoids that discussion entirely — while quietly counting approvals as victories.

Dashboards and accountability

What the City says: 133 initiatives tracked across seven priority areas.

What that actually means: A government that does many things and measures most of them vaguely.

What’s missing:

— Outcome metrics versus process metrics

— Baselines and targets

— What happens when goals are missed

— Data that can be downloaded and scrutinized

When everything is a priority, nothing is. A dashboard can clarify performance or obscure it. This one leans toward the latter.

Fiscal stewardship and bond ratings

What the City says: AA bond ratings across all categories.

What that actually means: Creditworthiness. The ability to borrow.

What’s missing

— Debt per capita trends

— Fee and utility cost growth

— Government staffing growth versus population

— Whether residents are paying more for the same services

Bond ratings tell investors the City is a safe bet. They do not tell residents they’re getting a good deal.

The omission that ties it all together

What’s striking about the Year in Review isn’t any single exaggeration. It’s the systematic absence of the metrics that actually determine whether a city is thriving:

— Median income

— Wage competitiveness

— Housing affordability

— Permit approval timelines

— Private-sector job quality

— Comparison to peer Florida cities

And our personal favorite: airport traffic.

Those numbers exist. The City simply chose not to show them.

Conclusion

Tallahassee has real strengths. Parks. Green space. Civic culture. Dedicated public employees. None of that needs to be diminished.

But a Year in Review that leans on awards, activity, and spending while avoiding outcome-level scrutiny is not a report card. It’s a highlight reel.

If City Hall, under Reese Goad, wants residents to believe Tallahassee is one of the best-run cities in Florida, it should stop asking them to admire the trophies and start showing them the math.

That’s not negativity. That’s governance.

January 14, 2026By Skip Foster, Red Tape Florida

BREAKING: CRA pulls $750,000 grant after Red Tape sniffs out pot dispensary plan

The Tallahassee Community Redevelopment Agency quietly pulled a proposed $750,000 Southside construction grant from its advisory board agenda Monday night after Red Tape Florida exposed that the project was intended to subsidize a marijuana dispensary — a fact not clearly disclosed in the public-facing materials. […]

January 13, 2026By Red Tape Florida

BREAKING: CRA pulls $750,000 grant after Red Tape sniffs out pot dispensary plan

By Red Tape Florida

The Tallahassee Community Redevelopment Agency quietly pulled a proposed $750,000 Southside construction grant from its advisory board agenda Monday night after Red Tape Florida exposed that the project was intended to subsidize a marijuana dispensary — a fact not clearly disclosed in the public-facing materials.

According to reporting by WTXL, the CRA item tied to a redevelopment project at 115 West Harrison Street was removed from consideration following public comment questioning both the use and the transparency of the grant.

That concern echoes a prior Red Tape Florida investigation, which found that while the CRA agenda summary described the project in generic terms — emphasizing “retail” and redevelopment — the applicant’s own documents revealed a different story. Buried deep in the attachments, including an appraisal section beginning on page 52, the intended use of the property was identified as a medical marijuana dispensary, with further confirmation later in the application.

In other words, the key word never appeared in the summary committee members and the public would reasonably rely on — only in dense supporting materials few would ever read.

Residents speaking at the meeting made clear that the objection was not to redevelopment writ large, but to the idea that tax-increment dollars intended for Southside revitalization could be used to subsidize a cannabis retail operation, particularly without clear disclosure up front.

It is unclear if the item will return at a later date, but the episode underscores a recurring concern with the City of Tallahassee Community Redevelopment Agency: critical project details disclosed only after public scrutiny, not before.

For now, the $750,000 grant remains off the table — and the dispensary question remains unanswered.

January 13, 2026By Red Tape Florida

When the world comes running: Tallahassee shows how sports tourism can be done

This weekend Tallahassee is hosting something truly historic: the World Athletics Cross Country Championships at Apalachee Regional Park, bringing the world’s best distance runners — and thousands of spectators — to our community. This isn’t just another local race or collegiate meet. […]

January 9, 2026By Red Tape Florida

When the world comes running: Tallahassee shows how sports tourism can be done

By Red Tape Florida

This weekend, Tallahassee is hosting something truly historic: the World Athletics Cross Country Championships at Apalachee Regional Park, bringing the world’s best distance runners — and thousands of spectators — to our community. This isn’t just another local race or collegiate meet. This is a global sporting event that lifts Tallahassee onto the international stage and embodies exactly what sports tourism should look like.

The 46th edition of the championships marks the first time the event has returned to the United States in more than 30 years. Apalachee Regional Park will be filled with elite runners representing more than 50 countries, competing across five championship races that will be broadcast around the world.

This week, world-class athletes and Olympians from nations like Kenya, Uganda, Ethiopia, Spain and Great Britain arrived in Tallahassee, and spectators have descended on our community to watch them compete. Organizers are expecting more than 450 of the world’s top runners, with economic impact estimates in the millions as visitors fill hotel rooms, dine in local restaurants, and experience our city’s unique hospitality.

What’s happening here is the culmination of years of strategic thinking and community investment. Tallahassee and Leon County didn’t stumble into this opportunity. Like any successful sports tourism destination, they built it. Apalachee Regional Park has hosted high-profile events for years — from NCAA championships to national meets — and that track record was essential to winning the bid for these world championships.

At the center of that long game has been county leadership, especially Leon County Administrator Vince Long. Back when the county first set its sights on hosting major cross countryevents, few could have predicted that those efforts would culminate in a world championship. But it was exactly that kind of long-term vision — of recognizing sports as an economic engine and leveraging it — that put Tallahassee in a position to win a global event of this caliber.

Under Long’s leadership, local officials, tourism partners, and community stakeholders worked together to elevate Apalachee Regional Park from a respected regional venue to a world-class site worthy of hosting the top names in athletics. That collaboration is the essence of effective sports tourism strategy: build quality facilities, cultivate experience hosting big events, and then leverage that to bring bigger opportunities home.

This weekend, as champions chase medals and cameras broadcast our city to millions, Tallahassee isn’t just hosting a race. It’s showing what sports tourism looks like when you back a plan with persistence, partnership and leadership.

Thanks to Vince Long and the team he’s helped steer, the world has a front-row seat — and Tallahassee is finally in the spotlight it’s long deserved.

January 9, 2026By Red Tape Florida