Florida’s Legislature finally moves on runaway impact fees. Now comes the hard part.

If Florida is serious about affordable housing, it must get serious about impact fees. […]

March 5, 2026By Skip Foster, Red Tape Florida

Florida’s Legislature finally moves on runaway impact fees. Now comes the hard part.

By Skip Foster, Red Tape Florida

If Florida is serious about affordable housing, it must get serious about impact fees.

For months, the House had been carrying that water largely alone. House Bill 1139 was moving methodically and quietly through committees while the Senate sat on its hands.

The Senate finally acted. Sort of.

Last week, the Senate Rules Committee approved a sweeping “delete everything” amendment to SB 1566 — a bill originally focused on local government financial transparency — and stuffed into it a significant package of impact fee reforms.

The maneuver is worth noting. Rather than give impact fee reform a standalone bill with its own hearing record and floor debate, the Senate buried it in a transparency omnibus through a late-filed amendment. That’s not how you signal that a policy is a priority. That’s how you check a box.

But the substance matters, and on substance, the amendment moves in the right direction.

What the Senate amendment actually does

Impact fees are the one-time charges cities and counties levy on new construction to fund roads, schools, parks and utilities. In theory, growth pays for growth. In practice, fees have exploded in some jurisdictions — with limited transparency, unpredictable timing, and math that local governments haven’t always been required to show.

The SB 1566 amendment would require that impact fees be grounded in a “demonstrated-need study” using what the bill calls a “plan-based methodology” — localized, current data tied to specific capital projects and projected growth over a defined period. The data can’t be more than four years old. The local government must adopt the study within 12 months if it wants to raise fees.

The amendment also codifies a protection that should go without saying: developers can’t be charged twice for the same transportation impact. When a county and a municipality both want a piece of the same infrastructure cost, they now have to coordinate through an interlocal agreement.

Critically, the amendment creates a new refund and credit process. If a developer overpays (it happens) the local government now has 30 days to respond to a written refund request and 30 days to deliver the refund or credit once elected. That accountability didn’t exist in statute before.

And for local governments that want to blow past the phase-in limits on fee increases? The amendment says they can, but only under “extraordinary circumstances,” only with a unanimous vote of their governing body, only after two publicly noticed workshops dedicated specifically to the extraordinary circumstances question, and only with a demonstrated-need study completed within the past year. That is a meaningful set of guardrails.

What it doesn’t do — and why that matters

No one is eliminating impact fees. The amendment does not zero them out. It does not strip local governments of revenue tools. It says: show your work. Show it with current data. Show it tied to real capital plans. And don’t blindside the market with sudden spikes you can’t defend.

That matters in a state where housing costs are suffocating working families.

Impact fees don’t get headlines. But add $15,000, $20,000 or $30,000 to the cost of a new home, and that invisible policy decision becomes very visible at the closing table. Unpredictability is a tax. When builders don’t know what fees will be six months from now, they price in risk. Risk becomes cost. Cost becomes higher home prices.

This is how decisions made in commission chambers end up pricing teachers, deputies and nurses out of the communities they serve.

Who’s opposing it

Predictably, the Florida Association of Counties and the Florida League of Cities have lined up against measures that constrain local fee authority. Their argument is familiar: local control, infrastructure needs, flexibility.

But here’s the tension.

You cannot hold press conferences about affordable housing and then oppose reforms that bring discipline and transparency to one of the largest local cost drivers embedded in new construction. That’s not a defense of local government. That’s protection of a revenue stream.

If a county or city truly has defensible math behind its impact fees, these reforms should not scare anyone. The requirement is alignment with capital plans and recent data. That’s not a burden. That’s competent governance.

The bigger picture

Florida’s housing crisis is not theoretical. Population growth continues. Construction costs remain elevated. Insurance remains volatile. Land is finite.

You cannot solve that equation while leaving every local cost lever untouched.

The Senate’s decision to move these provisions — even through a side door — is meaningful. But a delete-everything amendment filed late in session, tucked inside a transparency bill, is not the same as the Legislature treating this as a priority.

The question now is whether the House and Senate can reconcile their approaches and get something to the governor’s desk before session ends. HB 1139 and the SB 1566 amendment cover similar ground, but they are not identical. Conference will matter.

If lawmakers are serious about housing supply — not just speeches — the path forward is clear. Reconcile the bills. Pass the reforms. Show the work.

Opposing it, or letting it die in conference, sends a different message: that maintaining fee flexibility for local governments matters more than lowering the structural cost of a home.

Florida’s working families are watching. Even if they don’t know the bill numbers.

March 5, 2026By Skip Foster, Red Tape Florida

Memo to Siesta Key anti-growthers: You can’t collect bed tax from a pile of rubble

Siesta Key has become a case study in a familiar Florida contradiction: communities that depend heavily on tourism and redevelopment dollars while simultaneously trying to prevent redevelopment from occurring. […]

March 4, 2026By Skip Foster, Red Tape Florida

Memo to Siesta Key anti-growthers: You can’t collect bed tax from a pile of rubble

By Skip Foster, Red Tape Florida

Siesta Key has become a case study in a familiar Florida contradiction: communities that depend heavily on tourism and redevelopment dollars while simultaneously trying to prevent redevelopment from occurring.

A recent decision by the Sarasota County Commission on Nov. 12 to reject a Comprehensive Plan amendment underscores that tension sharply. According to coverage in the Observer, the proposal would have allowed aging, nonconforming condominium communities to voluntarily rebuild at their existing unit counts rather than conforming to today’s lower density limits

But here’s the uncomfortable reality: on a barrier island repeatedly exposed to hurricanes, newer construction is almost always safer, stronger, and more environmentally resilient than legacy structures built under outdated codes.

Florida’s building codes evolved dramatically after Hurricane Andrew. When the storm exposed widespread construction and enforcement failures, the state adopted a uniform Florida Building Code in 2002 with significantly stronger wind, flood, and structural requirements. Homes built under that code have sustained measurably less damage than older structures in comparable storms.

The most famous example is the so-called “Super House” in Mexico Beach — built to withstand extreme storm surge and catastrophic wind. When Hurricane Michael devastated much of the Panhandle, that reinforced concrete structure remained standing while older homes around it were destroyed. Even homes just on the leeward side of the “super house” were protected and suffered less damage. It became a national symbol of what resilient coastal construction can look like.

Siesta Key does not exist outside the laws of physics. When storms come — and they will — structures built to outdated standards are more vulnerable. Debris from older buildings becomes environmental contamination. Extended recovery slows tourism. Insurance pressures mount. Tax revenue drops.

If Sarasota County is deeply reliant on Siesta Key’s tourism tax revenue — and it is — then resilience is not optional. It is economic policy. Red Tape Florida has previously documented that Siesta Key generates roughly one in four of Sarasota County’s tourist-development tax dollars — revenue that flows largely into countywide spending rather than back to the island itself.

The regulatory framework is already in place: an overlay district, zoning rules, setback standards, short-term rental regulations, residential protections. What’s increasingly visible is a mindset that deploys anti-growth arguments to preserve a nostalgic version of the island, even when that approach conflicts with environmental durability and long-term economic health.

Freezing redevelopment does not freeze risk. It may amplify it.

When officials delay or deny projects that would replace older structures with modern, code-compliant buildings, they are not protecting the environment. They may be prolonging the life of the very structures most vulnerable to catastrophic failure in a major storm.

And when communities that benefit disproportionately from tourism tax revenue resist modernization while continuing to rely on that revenue stream — including for countywide obligations — the optics become harder to defend.

Barrier islands must evolve or they will erode — economically and structurally.

The real debate on Siesta Key shouldn’t be “growth versus no growth.” It should be this: are we encouraging smarter, stronger, storm-resilient redevelopment within existing zoning — or are we preserving aging vulnerability under the banner of nostalgia?

That’s not a culture war question. It’s a resilience question.

March 4, 2026By Skip Foster, Red Tape Florida

South Florida towns that blocked growth just admitted it was a mistake

For years, they rolled out the red tape.

Now they’re staring at the consequences — how to fund police and fire, maintain parks, and keep local government running when nearly all your revenue comes from homeowners.[…]

March 2, 2026By Skip Foster, Red Tape Florida

South Florida towns that blocked growth just admitted it was a mistake

By Skip Foster, Red Tape Florida

For years, they rolled out the red tape.

Now they’re staring at the consequences — how to fund police and fire, maintain parks, and keep local government running when nearly all your revenue comes from homeowners.

At a South Dade State of the Market event last week, the mayors of Pinecrest, Palmetto Bay and Cutler Bay did something rare for local officials — they admitted the obvious.

“We didn’t have the foresight to increase the zoning enough to bring in a commercial,” Pinecrest Mayor Joseph Corradino said, according to reporting by Chloe Gallivan in Bisnow. “Commercial wouldn’t be subject to the property tax issue, and we’re going to get crushed, probably because of short-sightedness.”

“Short-sightedness.” That’s not a blogger’s word. That’s the mayor’s.

The immediate backdrop was a state-level debate over property taxes. But the larger story has nothing to do with one bill in Tallahassee.

It’s about what happens when a town spends decades treating growth like a contagious disease.

Pinecrest is more than 90 percent single-family homes. Palmetto Bay is 92 percent single-family. These are communities that carefully curated their zoning maps to limit commercial intensity, restrict multifamily, and preserve a certain aesthetic.

That wasn’t accidental. It was enforced — by planning boards, by staff reports, by zoning codes thick enough to stun a horse.

Developers were told, politely or not, that this wasn’t Miami. Go build somewhere else.

And many did.

Here’s the problem: local governments don’t run on vibes. They run on revenue.

Police. Fire rescue. Infrastructure. Parks. Schools. All funded by a tax base that, in these towns, leans overwhelmingly on homeowners.

When you deliberately wall off commercial development, you’re not just protecting neighborhood character. You’re narrowing your revenue base to one economic lane.

That works fine — until it doesn’t.

When revenue growth slows, when costs rise, when policy shifts at the state level, there’s no cushion. There’s no diversified commercial sector absorbing part of the load. There’s just homeowners and a shrinking set of options.

And suddenly, the same governments that once treated developers like intruders are wishing they’d approved more storefronts.

Palmetto Bay offers a case study in lagging realization. The village implemented a pay-to-park system meant to support a future downtown vision. The idea: people will walk. The problem, as Mayor Karyn Cunningham admitted, is that “there’s nowhere to walk right now. There’s no retail there.”

You can’t regulate your way into an ecosystem. You either allow the market to build one — or you don’t.

Cutler Bay at least has the massive Southplace City Center redevelopment in the pipeline. That project could meaningfully diversify its tax base. But even there, Mayor Tim Meerbott acknowledged that until it’s built and stabilized, the town remains heavily dependent on homesteaded property taxes.

In other words, the diversification comes after you say yes — not while you’re still saying no.

This is the recurring theme Red Tape Florida has documented across the state: anti-growth zealotry feels principled in the short term and fragile in the long term.

Communities convince themselves they are protecting residents from traffic, density or change. Bureaucrats enforce the rules with precision. Permits get slower. Zoning stays tight. Projects get watered down or walk away.

And then — years later — the same leaders discover that fiscal resilience requires exactly the kind of growth they spent decades resisting.

Government slows growth. Growth goes elsewhere. The tax base stagnates. And eventually, government itself feels the squeeze.

That’s not ideology. That’s math.

No one is arguing for reckless overdevelopment. But pretending you can fund full-service municipal government indefinitely with a nearly all-residential tax base is fantasy.

The quiet part isn’t really about one property tax proposal.

It’s this: if you block commercial growth long enough, you don’t freeze your town in amber. You weaken your own foundation.

And when the numbers stop working, there’s no planning-board motion that can undo 20 years of saying no.

For many Florida cities and counties, the time to fix that mistake is right now.

March 2, 2026By Skip Foster, Red Tape Florida

A win is a win, but let’s not Breeze past context and history

Tallahassee International Airport is adding two new nonstop routes on Breeze Airways — Fort Lauderdale and Raleigh-Durham. […]

February 26, 2026By Skip Foster, Red Tape Florida

A win is a win, but let’s not Breeze past context and history

By Skip Foster, Red Tape Florida

Tallahassee International Airport is adding two new nonstop routes on Breeze Airways — Fort Lauderdale and Raleigh-Durham.

That’s really good news.

Full stop.

More destinations are better than fewer. And increased supply ought to eventually drive down price.

It wasn’t free – $3 million in Tallahassee taxpayer money is headed to Breeze as a part of the deal. But with a limited number of $39 introductory one-way fares, that’s a pill that many residents will find easier to swallow.

Now, let’s look at this development from cruising altitude and compare the new Breeze world to where TLH stood before Silver Airways shut down and JetBlue ended its brief Tallahassee flirtation.

The Silver/JetBlue baseline

Before Silver ceased operations in 2025, its Tallahassee network consisted of two nonstop destinations at its recent peak:

• Fort Lauderdale

• Tampa

Fort Lauderdale was the last route standing when Silver collapsed. Tampa had already been discontinued.

JetBlue’s Tallahassee experiment was brief. The airline launched daily nonstop service between TLH and Fort Lauderdale on January 4, 2024, then announced it was pulling out less than a year later, with its final Tallahassee departure on October 27, 2024.

What Breeze restores

The new Fort Lauderdale service restores that lost South Florida connection.

The Raleigh-Durham route is new.

Raleigh-Durham International Airport serves the Research Triangle region and offers strong domestic connectivity. It is not a legacy airline hub, and Breeze operates as a point-to-point carrier rather than a traditional hub-and-spoke airline, but Raleigh does expand geographic reach beyond Florida.

What this does not do

It does not restore Tampa service.

It does not dramatically increase frequency. Both Breeze routes are scheduled three times per week. That provides options, but not daily flexibility.

What it does do

It brings the airport back to roughly the same number of nonstop destinations Silver offered at its recent peak — but with a different mix.

Instead of Fort Lauderdale and Tampa, the lineup becomes Fort Lauderdale and Raleigh-Durham.

That’s likely a trade up. Tampa functioned largely as a Florida destination. Raleigh-Durham, by contrast, offers broader connectivity across the eastern seaboard — though Breeze itself operates primarily point-to-point.

The incentive reality

Airports across the country routinely offer incentives — fee waivers, marketing support, or revenue guarantees — to attract new service. Tallahassee is no different. That’s not unusual; it’s standard industry practice.

The real test is whether the routes remain once incentive periods end and the flights have to stand on their own economics. TLH’s track record with incentive-backed carriers is mixed. JetBlue’s brief run is a reminder that incentives can launch service — but they don’t guarantee permanence. Hopefully, Breeze will stick.

The bottom line

This is a solid development for TLH. The city regains a South Florida nonstop and gains access to a growing North Carolina market. It essentially returns TLH to the place it was earlier this decade

It does feel a bit like Tallahassee’s current restaurant scene, however – one opens; another closes.

Until Tallahassee experiences real population growth and economic development expansion, the calculus is unlikely to change.

February 26, 2026By Skip Foster, Red Tape Florida

Red Tape Florida is scaling up – and you can help

When I launched Red Tape Florida, I wasn’t building a business. I was testing an idea.

The idea: local government needs scrutiny that is informed, data-driven, and relentless. Not performative outrage. Not partisan theater. Just facts, public records, and clear arguments that follow the money.[…]

February 25, 2026Red Tape Florida is scaling up – and you can help

By Skip Foster, Red Tape Florida founder

When I launched Red Tape Florida, I wasn’t building a business. I was testing an idea.

The idea: local government needs scrutiny that is informed, data-driven, and relentless. Not performative outrage. Not partisan theater. Just facts, public records, and clear arguments that follow the money.

Thankfully, the response to RTF has proved the point.

Stories traveled. Traffic grew. Business leaders began forwarding documents. Citizens sent tips. Even local officials who don’t love the coverage started reading closely — because the work is hard to dismiss when it’sbacked by their own numbers.

When I see folks now – even those who have traditionally been aligned with the powers that be in local government – they invariably whisper “keep it up” or “that last one was great.”

Red Tape Florida has become a consistent civic voice in Tallahassee and beyond. In Ormond Beach, Temple Terrace, Siesta Key, Gulf County, and dozens of other communities, we’ve dissected questionable economic development deals, challenged inefficient fee structures, published records that would have stayed buried, and aired reform ideas that struggle to find oxygen elsewhere.

Here are some highlights:

- A story on a $35,000 luxury watch that became a North Florida Fair retirement gift.

- A story on a Tallahassee shed renovation that turned into nightmare.

- A state legislator responding to Red Tape Florida reporting and calling on Gulf County to shape up

And many more.

But the platform still runs on one resource: my time.

Deep investigations take hours. Records requests take persistence. Data work doesn’t do itself. Consistency requires discipline.

If Red Tape Florida is going to scale — in frequency, depth, and impact — it needs infrastructure.

Today, we’re launching the Red Tape Florida Supporter Program.

This is not a paywall. All content remains free and publicly accessible.

This is a voluntary model for readers who believe civic accountability shouldn’t fade when it becomes inconvenient or time-consuming. Supporters help fund deeper investigations, more records requests, and increased output across the platform.

There are three supporter levels:

- Civic Supporter — $25/month

- Core Supporter — $50/month

- Founding Supporter — $100/month

Supporters receive early access to major investigations, periodic impact briefings on reach and influence, and invitations to occasional gatherings. Most importantly, they help sustain a growing platform built on reform and accountability.

Red Tape Florida isn’t a traditional newsroom. It’s a civic accountability platform with a clear point of view: government should work, taxpayers deserve answers, and someone needs to show the receipts.

If you believe Tallahassee and communities across Florida benefit from sustained, informed scrutiny — and practical reform — I invite you to become a supporter.

The next phase will be bigger, more consistent, and more ambitious.

This is how we build it.

February 25, 2026Leon County runs at revenue — not recognition

By Skip Foster, Red Tape Florida

Leon County wants to send a delegation to Europe to pursue something ambitious: making Apalachee Regional Park the permanent home of the World Athletics Cross Country Championships.

Let’s start here: fiscal skepticism is healthy. We appreciate it. Taxpayer dollars deserve scrutiny.

But there is a time to pinch pennies — and there is a time to press an advantage.

This looks like the latter.

Leon County just hosted the 2026 World Athletics Cross Country Championships — the first time the event returned to the United States since 1992. Nearly 500 athletes from 52 countries competed at Apalachee Regional Park. More than 10,000 spectators attended. Broadcast coverage reached over 70 nations.

Preliminary projections presented to the Board estimate more than $4 million in direct economic impact.

Notice what that number is not.

It’s not $40 million. It’s not $75 million. It’s not padded with imaginary multipliers and “lifetime branding value.”

It’s a grounded, realistic number. And that makes it more credible.

If anything, given the attendance and international exposure, it may prove conservative when final numbers come in.

More importantly, this wasn’t a one-off experiment. Apalachee Regional Park has already generated $84 million in direct spending since 2013 through repeat championships and national events. The infrastructure is built. The course is proven. World Athletics President Sebastian Coe publicly called it “the best cross-country course in the world.”

That is leverage.

And leverage is something you use.

The travel being requested is not junketing. It is business development. It is follow-through. It is relationship management at the highest level of an international governing body that controls where future championships are awarded. And there is a chance a deal can be reached even without the travel.

But, if Leon County believes it can position ARP as the permanent home of this event — the way Omaha became synonymous with the College World Series and Williamsport with the Little League World Series — then this is exactly the moment to lean in.

The travel cost is estimated to be less than $20,000 and would come from bed tax dollars, not property tax revenue.

This is what those dollars are for.

Commissioner Rick Minor was the lone “no” vote on authorizing travel for the Chairman to join staff in upcoming in-person meetings with World Athletics leadership. Minor’s fiscal responsibility is laudable, but he appears to have missed the big picture of investing in a pitch to secure a strong return.

The County’s visionary approach is in stark contrast with other local approaches to “recognition.” The City of Tallahassee spent roughly $150,000 pursuing All-America City designation — a program that may bring civic pride and a nice plaque, but does not generate recurring tourism revenue, hotel nights, or international broadcast exposure.

There is nothing inherently wrong with civic awards. But let’s be honest about the difference.

One strategy produces a press release.

The other can produce repeat economic activity.

One is about recognition.

The other is about recurring business.

Leon County, under the leadership of County Manager Vince Long and his team, took a former landfill and turned it into one of the most respected cross-country venues in the world. That didn’t happen by accident. It happened through long-term investment and strategic follow-through.

Trying to lock in permanent-host status is not reckless. It is a calculated extension of a proven success.

There is always room for debate about travel. There is always room for caution.

But when you have momentum, international praise, realistic financial projections, and a tourism funding source designed for exactly this purpose — this is not the time to step back.

It’s time to run through the tape.

February 20, 2026By Skip Foster, Red Tape Florida

The shout: GDP grew! The whisper: It was mostly rent and government

The Office of Economic Vitality wants you to know that Tallahassee outpaced Florida and the nation in GDP growth last year. […]

February 16, 2026By Skip Foster, Red Tape Florida

The shout: GDP grew! The whisper: It was mostly rent and government

By Skip Foster, Red Tape Florida

The Office of Economic Vitality wants you to know that Tallahassee outpaced Florida and the nation in GDP growth last year.

That’s true.

The Tallahassee metro grew 4.3 percent in real, inflation-adjusted terms in 2024.

“GDP is one of the clearest indicators of overall economic activity,” OEV Director Keith Bowers said in yet another pro-OEV email sent via the City of Tallahassee’s email list.

But here’s the harder question:

If GDP rises and jobs don’t, which is actually the clearer indicator?

Because when you open the data — not the press release — the story looks less like “momentum” and more like something very Tallahassee.

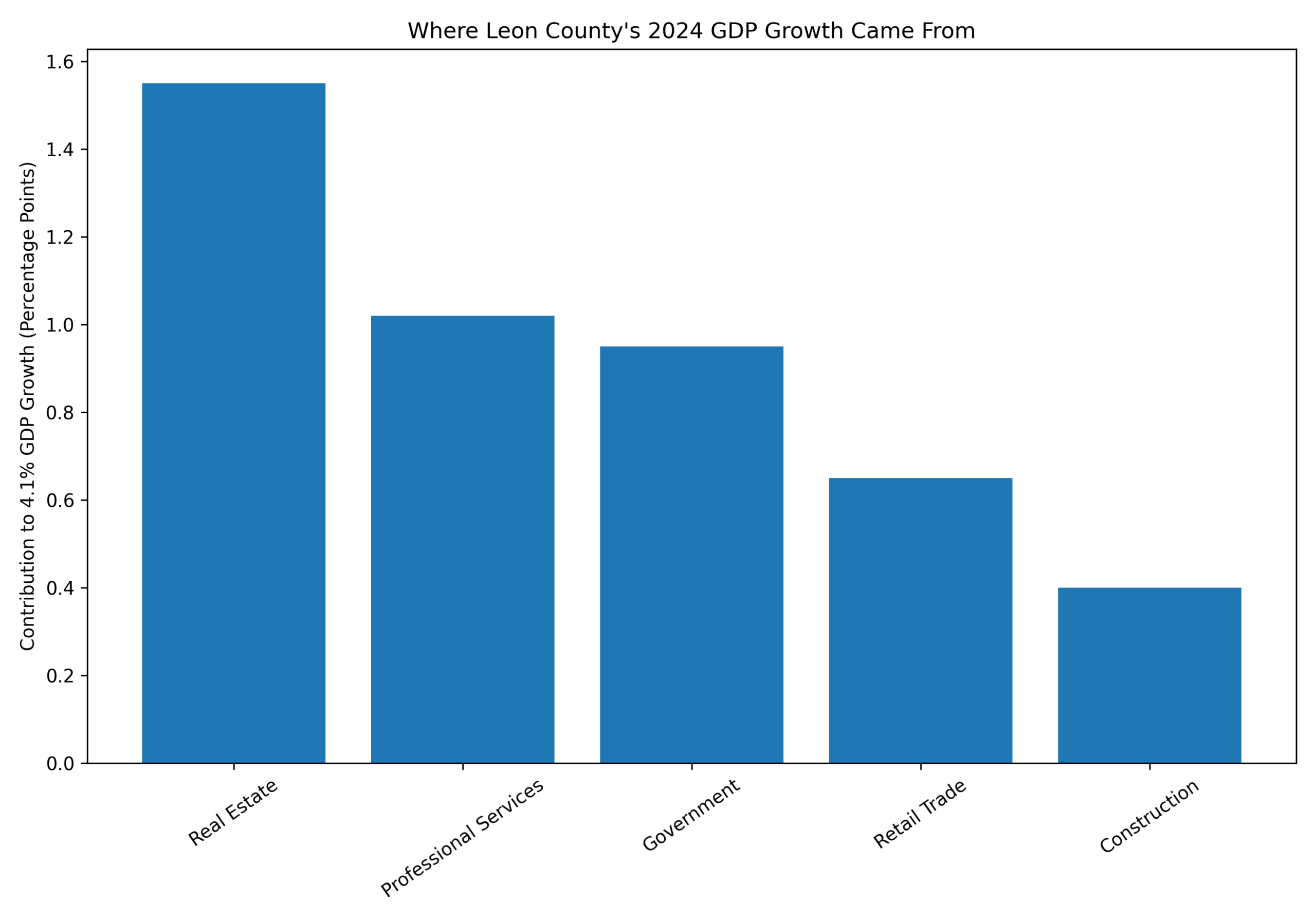

Leon County accounts for nearly 88 percent of metro GDP. Leon alone grew 4.7 percent in 2024.

And when you break that 4.7 percent apart, three sectors drove most of it:

- Real estate and rental and leasing

- Professional, scientific, and technical services

- Government

Yet manufacturing declined sharply in real terms. In fact, while overall GDP rose 4.7 percent in 2024, Leon County’s manufacturing sector contracted by roughly 20 percent in real terms — a stark divergence from the growth narrative.

(Readers can drill down into the data themselves, here)

This was not broad-based industrial expansion.

It was concentrated growth in property, services, and government.

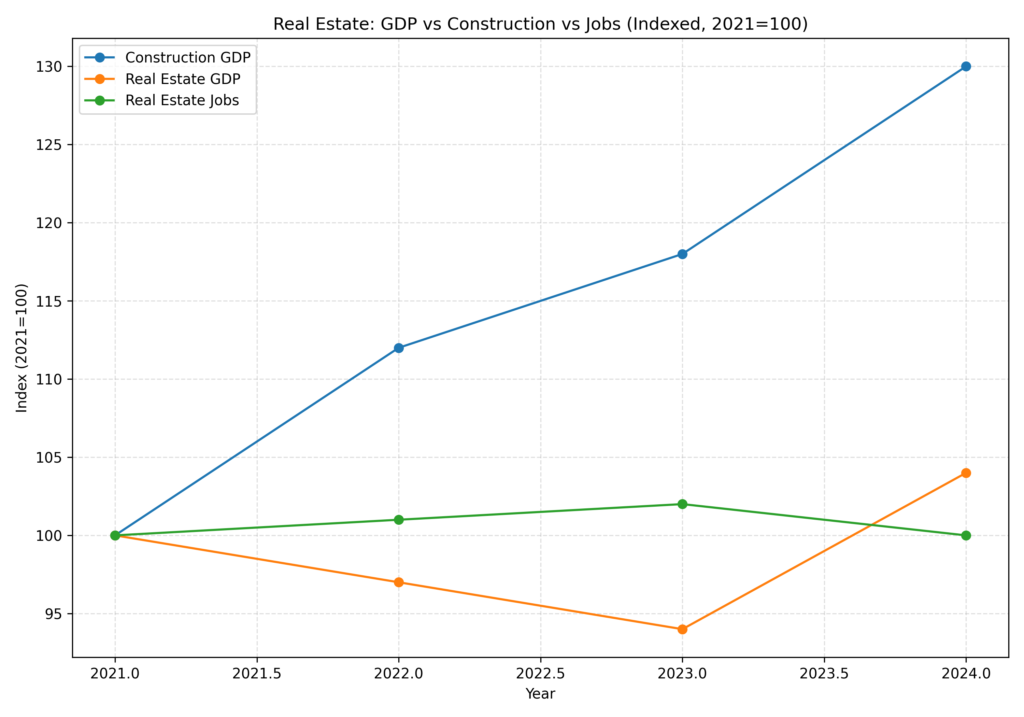

The rent year

Real estate and rental and leasing rose roughly 11 percent in 2024 — about $275 million in real value added.

That single sector accounted for roughly one-third of Leon County’s GDP growth.

Now here’s what didn’t happen:

- Real estate jobs did not surge. In fact, employment actually declined slightly.

- Total payroll barely moved.

GDP up 11 percent.

Jobs down.

That’s not a hiring boom.

It’s rent.

The U.S. Bureau of Economic Analysis’ real estate category measures value added from owning, renting, and managing property. It includes rental income and imputed housing services. It does not measure housing starts.

Construction rose in 2024 — but by a fraction of the real estate increase.

In a college town dominated by high-end student housing, this pattern makes sense.

When new projects are delivered and lease up at premium rents, net operating income rises. GDP rises with it.

But rising property income is not the same thing as expanding the economic base. If GDP growth is being driven primarily by higher luxury student housing rents in a college town, that deserves explanation — not just celebration.

Productivity, not hiring

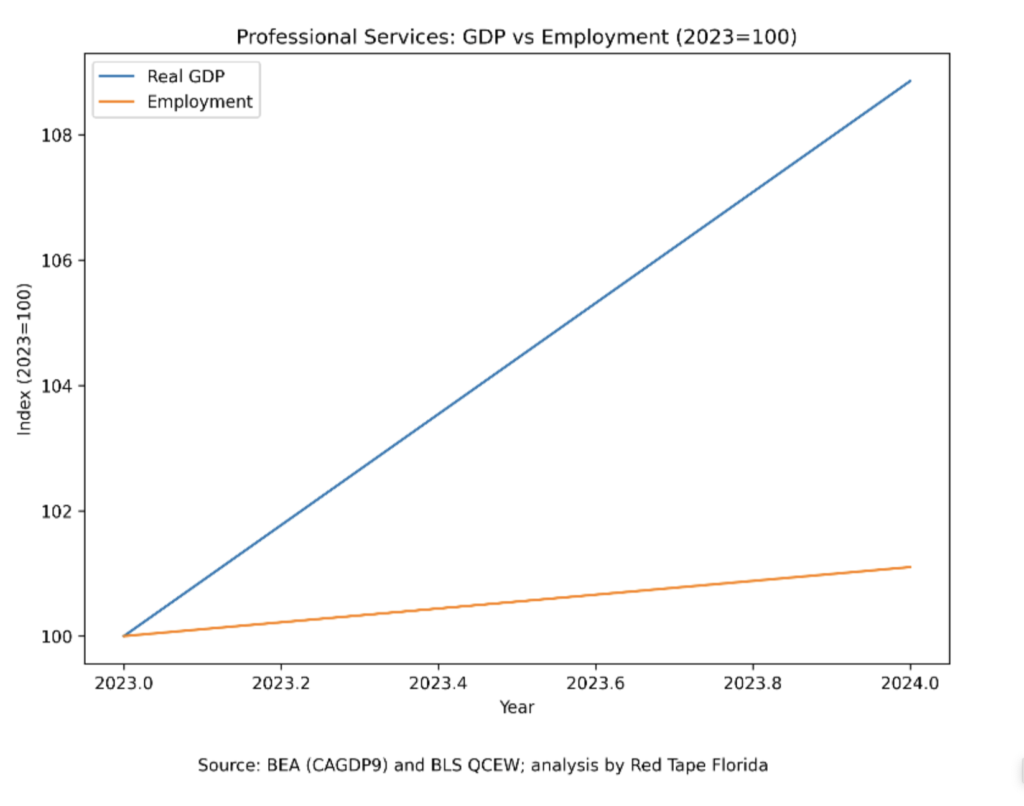

Professional, scientific, and technical services rose nearly 9 percent in real GDP — about $206 million.

That sounds like diversification.

But employment in the sector rose just 1.1 percent — 191 jobs.

GDP up almost 9 percent … headcount barely moved.

That means output per worker rose sharply.

Inside the sector, architectural and engineering services added jobs — likely tied to development and infrastructure work.

Computer systems design saw payroll jump sharply while employment stayed flat — a sign of higher contract value, not workforce expansion.

Scientific research and development services — where a dramatic university spillover would show up if one existed — grew modestly.

Again, this was more value generated by roughly the same number of people.

Which brings us back to OEV’s claim that GDP is the clearest indicator.

Is it?

The clearer indicator: jobs

In prior Red Tape Florida reporting, we’ve shown that Tallahassee’s job growth since 2023 has been flat to weak relative to peers. Employment gains have slowed materially. The region has struggled to generate sustained private-sector job expansion.

If GDP rises 4.7 percent and employment rises roughly 1 percent, then real GDP per job rises roughly 3–4 percent.

That means the economy produced more output per existing worker.

That is not nothing.

But it is not the same as:

- More residents employed.

- More families earning paychecks.

- A broader tax base.

- A more diversified private sector.

GDP measures value added.

Jobs measure participation.

If the goal is long-term economic vitality, job growth is often the more direct indicator of whether an economy is expanding its base.

A year where real estate value added rises, professional services bill more per worker, government grows steadily, and manufacturing contracts is not a transformational year.

There is one more structural piece of this story that cannot be ignored.

And, of course, government growth drove GDP

One other major contributor to 2024 GDP growth deserves attention: government.

Real (inflation-adjusted) government value added in Leon County rose roughly 3.75 percent in 2024 — an increase of about $169 million in real terms, according to BEA’s county GDP data.

That makes government one of the top three contributors to overall GDP growth last year.

And here’s the critical point:

GDP counts government output the same way it counts private-sector output.

If public payroll rises, if state agencies expand operations, if public enterprises generate more activity … GDP rises.

That’s how the metric works.

But in a state-capital economy like Tallahassee, that distinction matters.

Growth driven by:

- Property income,

- higher billings in professional services,

- and government value added …

… is structurally different from growth driven by new export industries, manufacturing expansion, or sustained private-sector hiring.

In prior Red Tape Florida reporting, we’ve shown that job growth has slowed materially since 2023 and that private-sector expansion has been uneven at best.

Against that backdrop, a year where government and property are major drivers of GDP growth doesn’t signal diversification.

It signals reinforcement of the existing model.

That may produce a strong headline.

But it’s not the same thing as economic transformation.

The bottom line

The ranking doesn’t change the structure

Yes, Tallahassee ranked near the top of Florida metros in 2024 GDP growth. But ranking doesn’t change composition.

The 4.3 percent headline is accurate. But the clearer indicator of where Tallahassee stands may not be GDP. It may be job growth.

We don’t blame OEV for highlighting positive metrics. But rankings and selective statistics can’t change the underlying reality:

- Out-of-town prospects describe a bureaucratic process that caused them to take their business elsewhere.

And, as we’ve said before, the performance is much more about a flawed structure, than poor leadership or performance.

All the rankings and stats and the world can’t change the fact that Tallahassee is not seeing growth in manufacturing, new business and jobs.

The best that can be extrapolated from GDP numbers touted by OEV is that In 2024, Tallahassee had a strong year for asset income, higher billings and the growth of government.

That is optimization.

Transformation looks different.

Until job growth reflects it, GDP alone is not the clearest indicator.

February 16, 2026By Skip Foster, Red Tape Florida

Florida’s Housing Supply Challenges and Strategies for Reform

Florida faces a chronic housing shortage that has significant implications for affordability, economic competitiveness, and quality of life. Housing demand continues to outstrip supply at both the state and local levels. […]

February 13, 2026By Samuel R. Staley, Ph.D., Director, DeVoe L. Moore Institute, Florida State University

Florida’s Housing Supply Challenges and Strategies for Reform

Special to Red Tape Florida

By Samuel R. Staley, Ph.D., Director, DeVoe L. Moore Institute, Florida State University

To our readers: The following are written comments provided by Dr. Staley to the Florida Senate, Committee on Community Affairs on December 9, 2025

Florida faces a chronic housing shortage that has significant implications for affordability, economic competitiveness, and quality of life. Housing demand continues to outstrip supply at both the state and local levels.

Florida adds approximately 750,000 people annually through in-migration from other states and foreign countries. Net migration creates demand for roughly 100,000 new housing units each year. These general numbers, however, underestimate their impact. Florida also experiences substantial churn in the housing market as existing households move up the “housing ladder.” Previously owned homes account for roughly 70 percent of residential purchases, and three-quarters of new homes are single-family detached. Much of what is considered “affordable housing” is provided through filtering of existing homes to different households. When new supply slows, filtering slows.

To better understand the implications of these trends, the DeVoe L. Moore Center commissioned an econometric analysis of housing demand and supply at statewide and county levels. The analysis estimates that Florida faces a chronic shortage of at least 55,000 rental housing units and 66,000 owner units. These estimates are likely a lower bound. The American Enterprise Institute Housing Center estimates that Florida is short approximately 486,000 homes, requiring additions equivalent to about five percent of the state’s current housing stock to restore equilibrium.

The shortage is persistent and widespread. Sixty-one of Florida’s 67 counties face chronic housing shortages. More than 90 percent of counties show shortages in owner-occupied housing, and more than 80 percent face shortages in rental housing.

This deficit has been a long time in the making. Beginning with the 2008 financial crisis, housing permits have failed to keep pace with Florida’s population and household growth. The cumulative result is a substantial housing gap.

The implications for affordability are significant. As the state continues to attract new residents and households, the inability to provide the right kind of housing in the right place at the right time contributes to a housing mismatch. This mismatch places upward pressure on rents and sale prices and constrains mobility within the housing market.

Regulation and land-use policy play an important role in this outcome.

Florida adopted statewide growth management in 1985, mandating detailed local comprehensive planning and land-use regulation. The law required long-term land-use planning according to state priorities rather than market demand. Empirical research found that housing prices increased faster in communities subject to longer periods under the Growth Management Act, contributing significantly to rising prices during its implementation.

Subsequent reforms reduced state compliance requirements, but local land-use planning and regulatory systems remain intact. Lengthy and uncertain approval processes for rezoning and development permits influence the ability of the private housing market to respond to shifting demand. The effects of regulatory delay and uncertainty on housing supply and affordability are well established in academic research.

Local governments vary widely in how they apply growth management rules. Differences in impact fees, development conditions, and approval timelines create financial uncertainty and reduce profit margins for builders. As profit margins narrow, builders shift toward higher-income housing segments. Lower-margin segments — including workforce and “missing middle” housing — become less financially viable.

As private developers reduce activity in these segments, the housing market becomes less robust. Florida is not building housing at a sufficient scale to allow filtering to operate effectively across income levels.

Reforming local growth management and land-use regulation is therefore a crucial step toward restoring market resilience. The role of the state in facilitating this reform, however, requires careful consideration.

Since 2010, Florida has largely delegated growth-management responsibilities to municipalities and counties. In principle, local governments are closer to residents and better positioned to respond to community concerns. In practice, however, land development and redevelopment processes have become highly politicized. Detailed zoning maps and discretionary approvals can transform routine land-use adjustments into political contests rather than evidence-based decisions.

The state can proactively address housing shortages by adjusting incentives faced by local governments.

One approach would be to prioritize housing within comprehensive plans and hold local governments accountable for meeting measurable housing objectives. Comprehensive plans often contain numerous elements competing for attention, and housing can become secondary to other priorities. Incentivizing measurable production goals could elevate housing as a central planning objective.

A second reform would focus development review on tangible and measurable impacts rather than generalized or aesthetic objections. Narrowing the grounds for delay and tying approvals to objective standards would reduce uncertainty and increase accountability.

A third reform would improve transparency and consistency in estimating impact fees. Impact fees contribute to higher housing costs, and wide variation in methodologies increases financial uncertainty. Ensuring that fees are clearly tied to actual infrastructure costs would improve predictability and reduce barriers to supply.

Beyond these state-level initiatives, local regulatory flexibility can increase housing responsiveness. Reducing minimum lot sizes, permitting administrative lot splits, and allowing accessory dwelling units (ADUs) can unlock incremental supply without dramatically altering neighborhood character.

ADUs, in particular, provide one of the least intrusive methods of increasing housing supply. Adding a unit over a garage or within the footprint of an existing home can improve financial sustainability for homeowners, expand options for residents in transition, and enhance mobility within the housing ladder while minimizing infrastructure impacts.

Florida’s housing shortage is chronic and of sufficient scale that policymakers should focus less on building for specific segments and more on enabling abundant housing across the board. Only by substantially increasing the supply of housing — both owner-occupied and rental — can price pressures moderate and affordability improve.

Florida has previously achieved periods of strong housing production when regulatory systems were more responsive to market demand. Restoring housing market resilience will require sustained attention to regulatory predictability, accountability, and supply flexibility.

The path forward is not complicated: create a more responsive and resilient housing market where builders and developers can sustain investment across the full range of housing products. Doing so is essential to maintaining Florida’s quality of life and economic competitiveness.

Dr. Sam Staley is director of the DeVoe Moore Institute at Florida State University and is one of the state’s most respected voices on housing policy.

February 13, 2026By Samuel R. Staley, Ph.D., Director, DeVoe L. Moore Institute, Florida State University

When a bureaucrat goes on vacation – and Temple Terrace permitting goes with him

Temple Terrace recently provided a textbook example of how fragile local permitting systems become when basic backup plans exist only on paper — or worse, only in emails.

[…]

By Skip Foster, Red Tape Florida

When a bureaucrat goes on vacation – and Temple Terrace permitting goes with him

By Skip Foster, Red Tape Florida

Temple Terrace recently provided a textbook example of how fragile local permitting systems become when basic backup plans exist only on paper — or worse, only in emails.

A homeowner needed a straightforward, safety-driven modification: converting a bathtub to a walk-in shower. The permit was submitted through a private provider, a process explicitly allowed under Florida law and intended to keep projects moving efficiently.

Even before the vacation delay, the private provider says the application faced resistance — including being told to deliver materials in person rather than electronically and to use city-specific forms not required by state law.

The application was submitted on May 25, 2025.

Then the City of Temple Terrace’s building official, Dallas Foss, went on vacation — and the permitting system effectively went with him.

What followed was not a minor delay or a paperwork hiccup, but a breakdown in authority that left contractors, residents, and even other government agencies trying to figure out who was actually in charge.

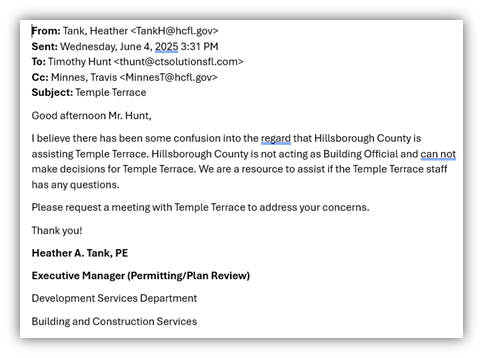

According to multiple emails from Temple Terrace’s permitting office, Hillsborough County was serving as the acting building official during Mr. Foss’s absence.

In one, Temple Terrace “permitting coordinator” Candace Willoughby, in an email obtained by Red Tape Florida, wrote to a building inspector on June 6 that “Mr. Foss is on vacation. We are using Hillsborough County BO.”

Contractors were told the county was “covering” and that work would continue.

There was only one problem.

Hillsborough County had no idea.

In a June 4 email, Hillsborough County Executive Manager Heather A. Tank, PE, put it plainly:

“I believe there has been some confusion into the regard that Hillsborough County is assisting Temple Terrace. Hillsborough County is not acting as Building Official and can not make decisions for Temple Terrace. We are a resource to assist if the Temple Terrace staff has any questions.”

That clarification came days after contractors had already been told otherwise by Temple Terrace staff.

Meanwhile, the permit remained untouched. From May 25 until mid-June, no action was taken, no alternative authority stepped in, and a routine safety project sat idle.

It was only after repeated emails on June 16, 2025 — following Mr. Foss’s return from vacation — that the permit was finally reviewed and issued.

The building official acknowledged the delay and apologized. City leadership later conceded that “we could have done better.”

But the episode raises a more uncomfortable question: what actually happened here?

Temple Terrace told applicants that Hillsborough County was “covering.” Hillsborough County says, in writing, that it was not. No formal backup agreement, interlocal arrangement, or delegated authority has been produced.

That leaves two possibilities. Either the city misunderstood its own coverage plan — or coverage was represented as existing when it did not.

The private provider also contends that Temple Terrace required procedures beyond what state law permits, including rejecting the standard state notice form and requiring inspections to be “scheduled” rather than simply noticed. Florida’s private-provider statute limits local governments from imposing requirements more stringent than those prescribed by state law. If accurate, that raises a separate compliance question.

This case surfaced only because the contractor pushed back and escalated. Most homeowners don’t. If one permit submitted on May 25 sat untouched until June 16 because a single official was out, it’s reasonable to ask how many others quietly stalled during the same period.

Florida’s permitting laws assume continuity. Permits are not supposed to pause because one person is on vacation. Yet in Temple Terrace, authority appears to have been so centralized — and so poorly documented — that a routine safety project effectively shut down.

That’s not just inefficient. It’s a governance failure.

When a city tells applicants that another government entity is providing coverage — and that entity later says it isn’t — trust erodes quickly. Mixed messages don’t just slow projects; they undermine confidence in the system itself.

This isn’t an argument against taking vacations. It’s an argument against pretending coverage exists when it doesn’t.

Temple Terrace says it is addressing the issue. That’s welcome. But the lesson applies far beyond one city.

When authority is unclear, delays aren’t accidents — they’re inevitable. And waiting weeks for a bureaucrat to return from vacation is not an acceptable outcome for residents trying to make their homes safer.

February 10, 2026By Skip Foster, Red Tape Florida

Tallahassee’s economy: ‘Momentum’ or spin

When governments are proud of their economic performance, they show residents jobs. When they’re not, they show rankings.[…]

February 5, 2026By Skip Foster, Red Tape Florida

Tallahassee’s economy: ‘Momentum’ or spin

By Skip Foster, Red Tape Florida

When governments are proud of their economic performance, they show residents jobs.

When they’re not, they show rankings.

That’s the only way to understand the City of Tallahassee Office of Economic Vitality’s Feb. 4 communiqué declaring that Tallahassee-Leon County’s economy is “building momentum” and that “the numbers show it.”

The OEV narrative that follows is not a serious economic analysis. It is a carefully assembled propaganda piece designed to distract from a stubborn and embarrassing reality: by OEV’s own data, Tallahassee is not growing — it is stagnating, and in some cases going backward.

Start with the rankings — because that’s where the deception begins.

OEV leads with a glowing national ranking from Area Development magazine, breathlessly announcing that Tallahassee-Leon County placed 16th overall among nearly 1,000metropolitan and micropolitan areas. That sounds impressive until you understand what this ranking actually rewards.

Area Development’s index is a blended soup of more than two dozen indicators, many of which favor government-heavy economies, long-term averages, and institutional stability. Tallahassee’s enormous state-government footprint, universities, and healthcare systems prop up these scores even when private-sector job creation is anemic.

In plain English: Tallahassee ranks well because it is stable — not because it is growing.

That distinction is not an accident. It is the entire point of using rankings instead of outcomes.

Next comes the “workforce strength” sleight of hand.

OEV touts a top-20 national ranking for “Prime Workforce” performance, citing wage growth, labor-force trends, and STEM employment shares. What the release never explains is where these jobs are actually coming from.

Much of Tallahassee’s wage growth mirrors national inflation and public-sector pay adjustments, not a competitive private market. Meanwhile, counting the share of STEM workers is meaningless when the region continues to struggle to attract the private employers who would hire them. A “strong workforce” that must leave town to thrive is not a strength — it’s a failure.

Then comes perhaps the most unintentionally revealing boast of all.

OEV proudly notes that roughly one-third of workers employed in Tallahassee-Leon County commute in from surrounding counties, framing this as evidence that Tallahassee is a powerful regional employment hub. In reality, this is not a flex. It’s a flashing warning light.

While growing a regional economy is a laudable goal, high inbound commuting often signals that the core city is failing to generate enough well-paid resident workers to support household formation and long-term wealth creation. Tallahassee captures labor during the day and exports wages, homeownership, and tax base at night.

The American Planning Association’s PAS Report on jobs–housing balance explains that when communities have a persistent mismatch between where jobs are and where workers can afford to live, the result is longer commutes and higher household transportation costs — and those costs can erase or outweigh wage gains, while also increasing regional congestion and infrastructure burdens

A thriving economy retains its workers. It doesn’t rent them.

But the most glaring omission in OEV’s entire release is the one statistic it absolutely refuses to confront: its own jobs data, as revealed in a recent Red Tape Florida story.

According to OEV’s own employment chart, Leon County had roughly 159,000 jobs in late 2022. By late 2025, that number had fallen to about 158,000. That is not momentum. That is net job loss — quietly buried beneath glossy language and national rankings.

To paper over this failure, OEV resorts to one of the oldest tricks in the economic-development spin book: anchoring job growth to April 2020, when pandemic shutdowns collapsed employment. Starting from the bottom of a once-in-a-century economic shutdown allows almost any community to claim dramatic “growth.”

Recovery is not success. Rebounding is not momentum. And Tallahassee’s post-pandemic performance remains weak even by that generous standard.

The Florida Chamber of Commerce, using the same federal data OEV selectively cites, reported that Leon County lost more than 4,000 jobs year-over-year — a fact OEV dismisses because it is inconvenient, not because it is wrong.

And here’s the most telling detail of all: in 2025, OEV did not announce a single new economic-development project that added jobs. Not one. No relocations. No expansions. No headline wins. Just rankings, rankings, rankings.

The release closes with optimism about real-estate “prospects,” citing a national perception survey showing improved sentiment among investors. Sentiment, however, does not build office space. Surveys do not sign paychecks. And optimism does not create private-sector jobs.

Perhaps Tallahassee-Leon’s job numbers would be better if OEV spent less time on self-congratulatory rankings report and more time on actually recruiting new business to our community.

Tallahassee residents do not live inside rankings.

They live inside paychecks. Inside housing costs. Inside career ceilings. Inside a local economy that has spent years confusing institutional stability with economic success.

Until the city is willing to show honest, current job numbers — without pandemic baselines, without composite rankings, and without propaganda — talk of “momentum” is not analysis.

It’s marketing. And it’s insulting.

February 5, 2026By Skip Foster, Red Tape Florida