Florida built a fast lane. Gulf County added a toll.

Imagine you play a round of golf at a private course instead of a city-owned golf facility. But when you’re done, the city still sends you a greens-fee bill … and then makes you swing by their municipal course clubhouse to fill out some paperwork before you can go home.[…]

October 10, 2025Red Tape Florida

Florida built a fast lane. Gulf County added a toll.

By Skip Foster, Red Tape Florida

Imagine you play a round of golf at a private course instead of a city-owned golf facility.

But when you’re done, the city still sends you a greens-fee bill … and then makes you swing by their municipal course clubhouse to fill out some paperwork before you can go home.

That’s what Gulf County is doing to local businesses who choose to use private providers for inspection services, rather than the County.

Gulf County is charging businesses $500 to do nothing. It’s a violation of state law and common sense.

And Gulf County doesn’t appear to care.

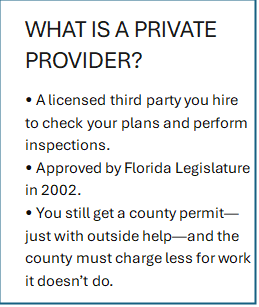

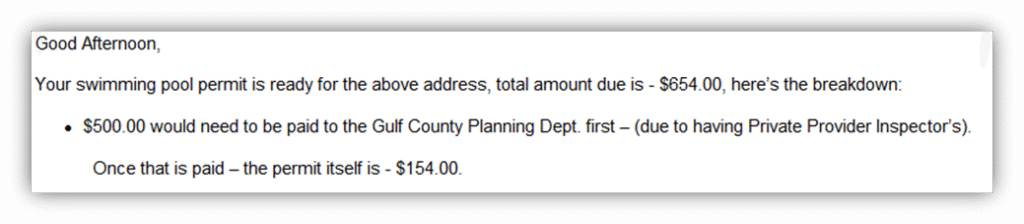

A few weeks ago, Red Tape Florida flagged Gulf County’s $500 add-on that appears when applicants use a private provider for plan review. Now, RTF has obtained internal Gulf County emails that reveal what the County is telling businesses: If you use a private provider instead of our bureaucrats, you will either pay an extra $500 or go through a slower permitting process … or both.

The County gives builders two lanes:

Option 1: Use County staff for plan review and inspections, and you skip the toll and the detour.

Option 2: Use a private provider for plan review — the state’s fast lane — and the County slaps a $500 charge on your permit and forces an extra stop at the Planning Department before the Building Department will touch your file or give you a permit.

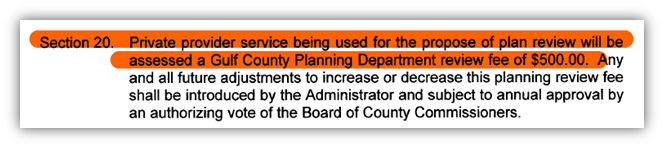

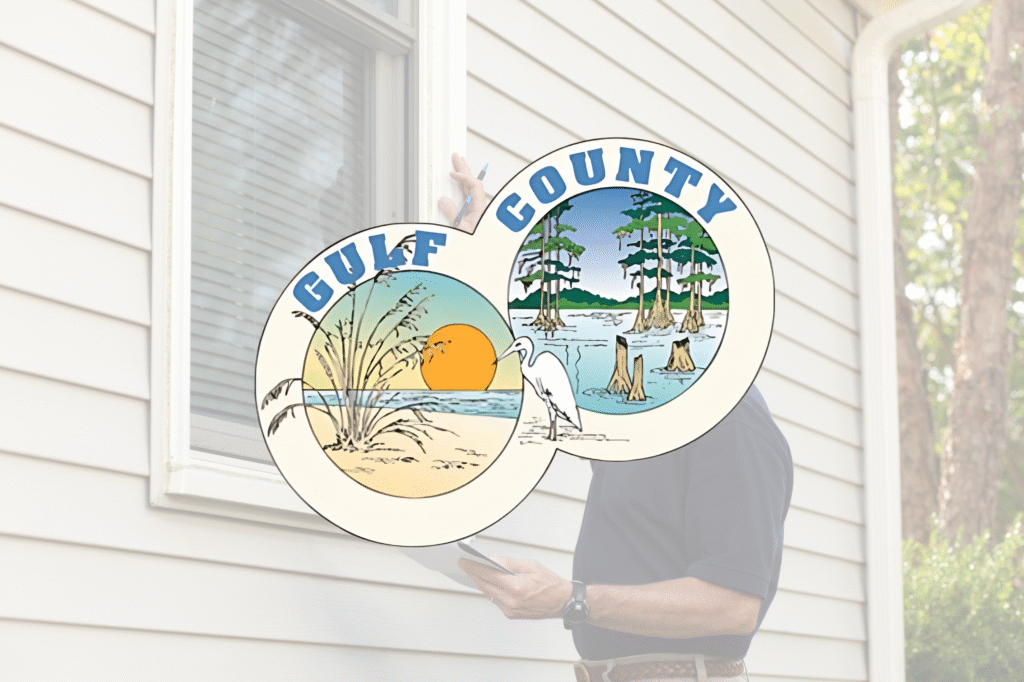

Gulf County is so comfortable with this clear flouting of state law that they wrote it into county code: “Private provider service being used for the propose (sic) of plan review will be assessed a Gulf County Planning Department review fee of $500.00.” Same plans, same counter, same door — extra fee and detour only if you use the private provider fast lane. That’s unequal treatment by design.

What the law requires vs. what Gulf County is doing

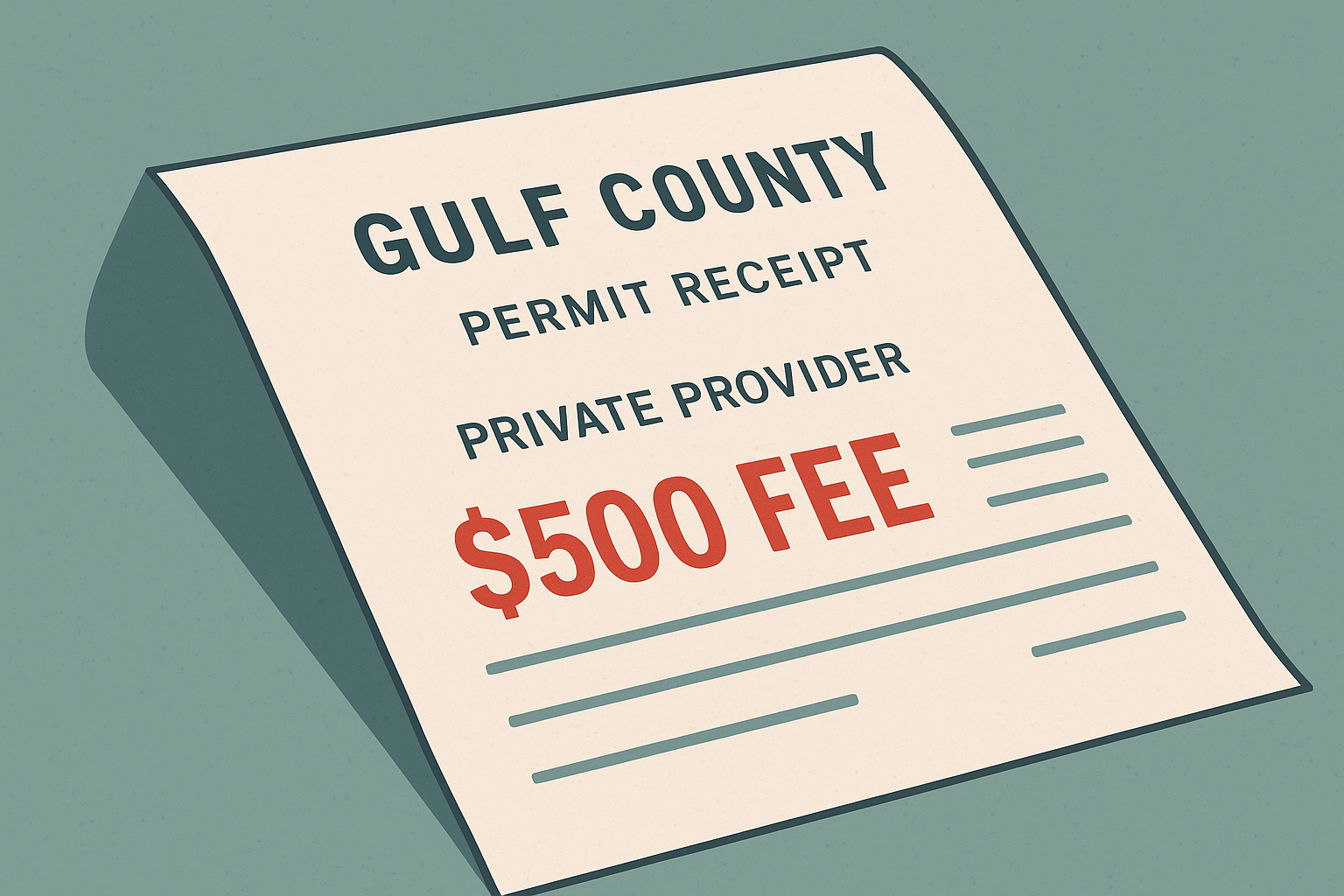

In 2002, lawmakers effectively “privatized” parts of permitting by authorizing licensed private providers to handle plan review and building inspections in lieu of local staff — so projects could move faster and departments couldn’t bottleneck the process.

The elements of Florida Statute 553.791, in plain English:

- If a private provider does plan review, the county must reduce the permit fee to reflect the work it didn’t do. If a private provider does inspections, the county may not charge inspection fees—only a reasonable administrative fee tied to actual clerical/supervisory time.

- Local governments can’t add stricter procedures that discourage private provider use.

What Gulf County is doing instead.

- If you use a private provider for plan review, you must stop at Planning, pay $500, then carry the file to Building.

- If you use a private provider for inspections only, you go to Building with no $500

- If you use the county for everything, you go to Building, no $500, no extra stop.

That’s two tracks at the same counter. Extra money and extra steps only when you choose the state’s fast lane. If $500 truly covers Planning’s work, it should apply no matter who reviews the plans and it should be based on time and cost, not a checkbox.

This email, obtained by Red Tape Florida, lays it out for all to see:

Read it again.

The permit itself is just $154.00. But because a private inspector is used, an amount more than triple the cost of the fee is assessed.

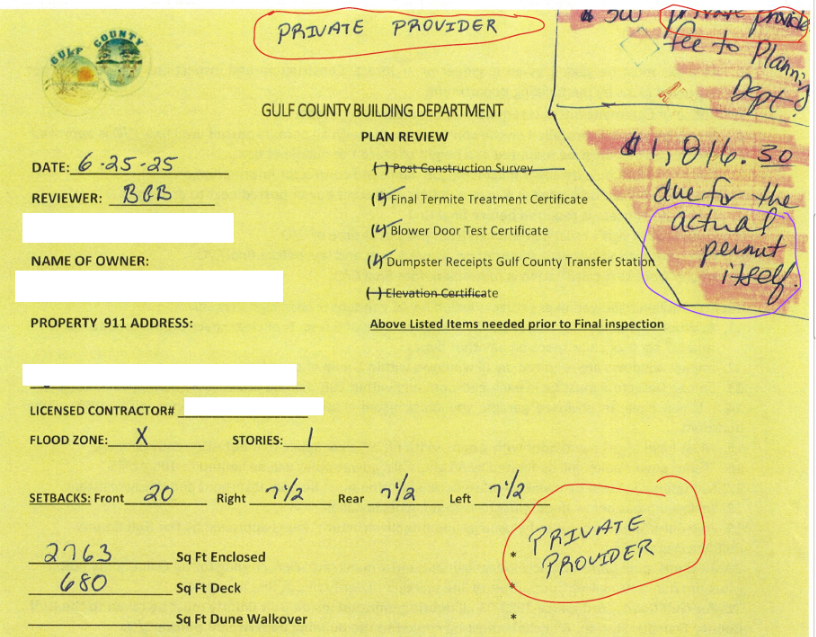

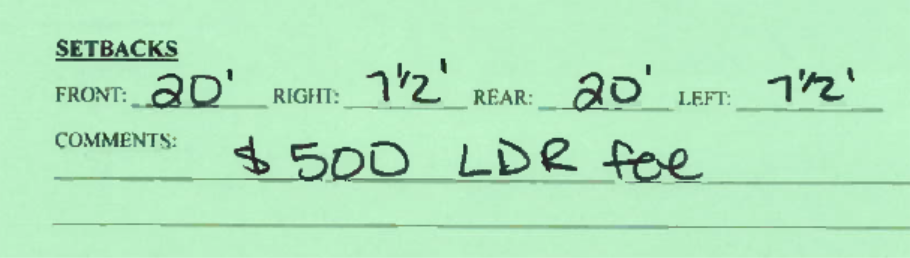

Gulf County’s flouting of state law is clearly premeditated – how else would you explain how the naming of this $500 fee has, how shall we say … evolved?

As you can see from this permitting plan review document below (business names redacted for fear of retribution) the words “Private Provider” are recorded on the document 3 separate times (circled in red by Red Tape Florida). One of those times it is handwritten at the top of the form: “$500 private provider fee to Planning Department.”

The $1,816 (for a larger building project) is brazenly referred to as “the actual permit itself.”

Later, when Gulf County realized this was the equivalent of confession, it changed the $500 fee to a LDR or “local development review” fee (a term only a true bureaucrat could create).

Gulf County can call it whatever it wants, but it’s a $500 fee to NOT use government inspectors.

Why this matters to homeowners and small contractors

Every extra step slows a roof, a pool, an addition. After storms, days turn into weeks. Costs go up. Families wait. The Legislature created private providers to speed things along and mandated a fee reduction when private providers are used. Gulf County’s rule does the opposite and tells people they will be punished for using the tool the state gave them.

How does it work in other localities?

Nothing like Gulf.

In nearby Panama City Beach, RTF has obtained a permit for a new pool which costs a total of $208.63. There is no punitive fee for using private providers.

In Bay County, a $250 “planning compliance review fee” is added to ALL permits (another RTF story for another time) and the pool permit itself is $106 for a total of $356, still contrary to the state mandate, but lower than nearby – and much smaller – Gulf County.

But in Gulf County it’s $500 for just the “you didn’t use us” surcharge, then another $154 for the permit itself, for a grant total of $654. Gulf County then has the gall to include a $60 “private provider discount” to the order, making the grand total a $595, which is about triple Panama City Beach and more than 60 percent higher than Bay County.

What Gulf County should do now

- Suspend the $500 charge that appears only when private provider plan review is used.

- Publish the ordinance and the time-and-cost basis for any true administrative fee.

- Reduce fees by the amount of the cost savings realized by the County any time private providers do plan review or inspections, as the law requires.

- Remove extra handoffs that apply only to private-provider routes.

- Refund improper charges.

A call for the state CFO to intervene

Since Gulf County will surely ignore our call to change its process, it’s surely time for Florida CFO Blaise Ingoglia to intervene. The CFO’s state DOGE efforts have understandably focused on the “macro” of total budget expenditures by cities and counties. But, on behalf of local businesses under siege from defiant bureaucrats, we call on CFO Ingoglia to enter the fray on issues such as what Gulf County is doing to thwart business and protect its bureaucracy.

How readers can help

If you’ve been charged the $500, send a redacted receipt or invoice with the date, permit type, and whether a private provider handled plan review or inspections. If you were routed through extra steps only because you used a private provider, send that, too. If a neighboring county has a similar fee and a cost study, share it so we can compare apples to apples.

Closing

This isn’t complicated. Same plans, same counter, same door should mean the same treatment. The state built a fast lane to help people rebuild faster. Gulf County put up a toll and a speed bump. Take them down. If the County won’t do it, the state should.

Red Tape Florida

Dunnellon’s Creosote Standoff Shows How Florida’s Permitting Culture Breeds Paralysis

A small item out of Dunnellon last week speaks volumes about how Florida’s permitting culture turns decisions into stalemates and pushes investment into quicksand.

Track Line Rail LLC says it wants to shred old railroad ties on privately owned land in unincorporated Marion County, near the city of Dunnellon. Because those ties are treated with creosote, a petroleum-based preservative, the Florida Department of Environmental Protection has permitting authority. That’s state law. But Dunnellon officials want the project stopped and have now formally urged DEP to deny the permit, citing health and environmental risks.

So far, that sounds like an ordinary disagreement about land use. But look closer and you see the problem we highlight again and again: nobody is actually empowered to bring clarity or finality, and everyone has just enough jurisdiction to say no — but not enough authority to resolve anything.

The site isn’t inside Dunnellon city limits. It’s in the county. Yet the city is intervening because residents are worried. The county hasn’t made a definitive public statement. The company says it’s following DEP’s process. DEP will evaluate environmental factors, but it isn’t in the business of judging economic or community fit. Meanwhile: confusion, delay, anxiety and rumors.

Florida’s regulatory system increasingly functions like this: overlapping entities, unclear triggers, and long silence from the agency that actually carries the stamp of approval. When government actors can jump into a process without clear authority — or when authority exists but timelines don’t — the message to businesses and citizens is the same: get comfortable waiting. And while you do, assume the worst.

None of this is about whether a creosote-related operation is good or bad. Reasonable people can disagree on environmental risk. The question is whether Florida has a permitting framework built for transparency and confidence or one that invites fear, mobilizes opposition before facts are clear, and rewards whoever can shout longest.

Consider the incentives here. The applicant has no guarantee of timeline or decision standard. The city, despite lacking jurisdiction, can effectively stall the process by raising political heat. The county can keep its head down and avoid controversy. DEP, already stretched and slow on industrial reviews, is unlikely to act quickly under pressure.

So what we end up with is not environmental stewardship or economic strategy — but bureaucratic drift that makes everybody feel underserved.

If a project poses legitimate environmental risk, the permitting authority should say so promptly and clearly. If it doesn’t, the applicant shouldn’t be trapped in limbo while local governments without jurisdiction form a de facto veto.

The lesson out of Dunnellon is simple: Florida needs clear decision timelines, transparent standards, and a single point of authority for land-use questions — even when multiple governments have interests. Otherwise, the state’s growth conversation becomes an endless loop of suspicion and stalling.

Nobody benefits from a process that refuses to decide. And the more it happens, the more Florida earns a reputation for uncertainty — the most corrosive form of red tape there is.

November 4, 2025Red Tape Florida

Gulf County doubles down on its $500 toll — and doubles down on being wrong

Gulf County has now responded to Red Tape Florida’s reporting on its illegal $500 “planning review fee” for builders who use private inspectors. The response, signed by County Planner Doug Crane, is exactly what you’d expect from a government caught in the act: a lot of bluster, a little jargon, and not one sentence that makes the fee legal. […]

October 24, 2025Red Tape Florida

Gulf County doubles down on its $500 toll — and doubles down on being wrong

Gulf County has now responded to Red Tape Florida’s reporting on its illegal $500 “planning review fee” for builders who use private inspectors. The response, signed by County Planner Doug Crane, is exactly what you’d expect from a government caught in the act: a lot of bluster, a little jargon, and not one sentence that makes the fee legal.

Crane’s letter lists a dozen things the county does to “safeguard health, safety and welfare” — confirming ownership, verifying setbacks, checking FEMA zones, and so on — as if this were some special service for those using private providers. The problem? The county does every one of those things already for builders who don’t use private providers. And it doesn’t charge them $500!

That’s not a “planning review.” That’s a selective surcharge, and Florida law couldn’t be clearer about it.

Under Florida Statute §553.791(2)(a):

“The local jurisdiction may not charge fees for building inspections if the fee owner or contractor hires a private provider … however, the local jurisdiction may charge a reasonable administrative fee, which shall be based on the cost that is actually incurred … for the clerical and supervisory assistance required.”

Translation: the only fee a county can impose when a private provider is used must reflect actual clerical or supervisory cost — not a made-up round number like $500 that conveniently lands in the general fund.

Then there’s §553.791(17)(a):

“A local enforcement agency, local building official, or local government may not adopt or enforce any laws, rules, procedures, policies, qualifications, or standards more stringent than those prescribed by this section.”

Gulf County’s letter literally admits it’s doing exactly that — layering its own checklist and charging an extra fee that doesn’t apply to anyone else. That’s the definition of “more stringent.”

Crane tries to justify the toll by saying it covers “staff time, documentation verification, and on-site evaluations.” Yet §553.791 says those evaluations are already part of the building process. The private provider handles inspections; the local government’s role is administrative oversight — not duplication for profit.

And remember, Gulf County is so brazen about what it’s doing it wrote it right into its code:

Let’s call this what it is: a toll for exercising a right the Legislature gave you. A $500 penalty for using a system designed to make housing more affordable and efficient. A county government that sees a reform meant to cut red tape — and adds its own roll of tape right on top.

Representative Jason Shoaf is already watching. His exclusive statement to RTF last week made that clear:

“I’m calling on all political subdivisions of the state to immediately suspend this practice and start following Florida law.”

The Legislature built a fast lane. Gulf County built a toll booth. And no matter how many bullet points the planner adds, §553.791 says what it says — and Gulf County is wrong.

October 24, 2025Red Tape Florida

FAC falling for Gulf County’s schtick on the use of private provider inspections

Here we go again: county bureaucrats who don’t like a state law are circling the wagons, slow-walking compliance, and now trying to rewrite reality to make it sound like private providers are bad for residents and business. The Florida Association of Counties’ Community & Urban Affairs Committee is pushing an agenda item dressed up as “citizen protection,” but its own packet undercuts the scare story it’s selling. […]

October 17, 2025FAC falling for Gulf County’s schtick on the use of private provider inspections

TALLAHASSEE — Here we go again: county bureaucrats who don’t like a state law are circling the wagons, slow-walking compliance, and now trying to rewrite reality to make it sound like private providers are bad for residents and business. The Florida Association of Counties’ Community & Urban Affairs Committee is pushing an agenda item dressed up as “citizen protection,” but its own packet undercuts the scare story it’s selling.

The packet’s central claim is “secrecy” — that a contractor can use a private provider without the homeowner’s knowledge. So what? Homeowners hire licensed professionals precisely to make hundreds of technical decisions they don’t micromanage — which inspector to schedule is no different from which truss detail to spec.

The use of private providers, with or without homeowner signoff, is specifically permitted in Florida statutes. Private providers are licensed, certified, and insured to the same state standards as their public-sector counterparts. We all know that the private sector almost always moves more quickly and efficiently than the government. If a homeowner wants to be notified, that’s a contract choice between owner and contractor — not a pretext for counties to kneecap a lawful option.

We’re told private providers were “designed for bigger cities” or post-hurricane spikes, as if rural counties were never in the picture. But the packet also reminds readers the Florida Building Code is meant to apply uniformly across jurisdictions and that private providers have been in statute since 2002 – that’s 23 years! Translation: this isn’t a Miami carve-out — it’s statewide policy that counties have had decades to implement.

On oversight, the sales pitch is “lack of control.” The FAC agenda item tries to bury reality in the fine print, which lists the controls: sworn plan certifications; phase-by-phase inspections; 10-business-day permit timelines after affidavit; sworn certification of code compliance upon completion; and since 2024, mandatory, published audit procedures with results posted for the public.

If “no oversight” is your talking point while you quote the oversight, maybe the talking point needs an audit.

The fiscal bogeyman is even thinner. The packet declares “devastating financial impacts” on Gulf County and its residents, offers no numbers, and then quietly notes that when an owner elects to use a private provider, the permit fee must be reduced to reflect the county’s actual cost savings — with only a reasonable administrative fee allowed. If the math is so devastating, show it. Otherwise, this reads like counties protecting fee revenue, not homeowners.

And, of course, what we know is that it’s the private sector that is taking it in the teeth on this. Gulf County is charging businesses $500 for the use of private providers – and doing absolutely nothing in return.

The legislative rundown is similar sleight of hand. The “loss of local control” language is pinned to a bill that died. The one that passed in 2025 tweaked single-trade inspections and allowed limited post-start use of providers — hardly a system meltdown. Panic without provenance is politics, not policy.

And take a look at who submitted the item: Gulf County — via Brad Bailey. Readers of Red Tape Florida will remember Bailey from our reporting on Gulf’s flat $500 “review” fee when owners chose private providers. Bailey is not a licensed plans examiner nor does he have a building code administrator license, which makes him an odd face for an anti–private provider push built on technical authority. The through-line isn’t safety — it’s bureaucracy protecting its turf.

Bottom line: Florida’s private-provider law gives owners a legal, licensed, insured alternative to the use of local building departments – who often can’t or won’t deliver timely reviews and inspections. The packet trying to kneecap that option reads like a brief for preserving status quo revenue and control — not for protecting consumers. If counties want new tools, say what and why. But stop flouting the law, stop inventing problems, and stop pretending homeowners and small builders are the threat.

FAC shouldn’t embarrass itself further by advancing this item — a straw house, built on sand by an unlicensed builder.

Here’s a better idea – tell Gulf County start following the law.

October 17, 2025

Fees are taxes in sheep’s clothing

Property-tax scrutiny is pushing cities and counties toward a quieter revenue source: fees. In theory, fees are better than taxes because they connect what you pay to what you use. In practice, many of today’s “fees” are compulsory, appear on the property-tax bill, and climb steeply — functioning like taxes by another name.[…]

October 14, 2025Red Tape Florida

Fees are taxes in sheep’s clothing

If you don’t have a choice to pay it, it’s not really a fee

Property-tax scrutiny is pushing cities and counties toward a quieter revenue source: fees. In theory, fees are better than taxes because they connect what you pay to what you use. In practice, many of today’s “fees” are compulsory, appear on the property-tax bill, and climb steeply — functioning like taxes by another name.

Start with public safety. Kissimmee just created a $150 annual fire assessment to fund a shift to a 42-hour work week and new hires; commissioners framed it as the only realistic way to cover rising costs without jacking up the millage. Nearby Ocoee doubled its fire fee from $69.50 to $139.23 per “fire protection unit,” explicitly to avoid a property-tax increase.

The Tallahassee–Leon fire-services fight hinges on the City’s push for a massive fee hike: in June, commissioners backed a roughly 22–25% increase set to take effect in September; after the County voted 5–2 to reject it, the City floated a pared-back 9.98% “Plan B,” then on Sept. 17 voted to sever the interlocal fire-services agreement.

Stormwater is on the same path. Last year Orlando approved a multiyear schedule that lifts the typical residential stormwater bill toward about $21 a month by 2028; city staff said the jump was overdue after years without increases. Oviedo adopted annual stormwater hikes through 2033 that will push typical monthly charges well over $40 to finance a backlog of projects.

If these were simply user fees, you’d pay at the counter and opt out by not using the service. That’s not how they work. Florida’s “non-ad valorem assessments” are levied by local governments, posted on the same bill as your property taxes, and collected by the tax collector. Courts have long noted that special assessments aren’t ad valorem taxes, but they can still be imposed broadly when there’s a defined “special benefit” to property. That’s why fire and stormwater assessments can reach properties that otherwise pay little or no property tax. Orlando even spells it out plainly: stormwater is billed as a non-ad valorem charge on the annual tax bill.

Meanwhile, state leaders are floating big property-tax changes for homesteads, which only increases the incentive for locals to lean on assessments and fees instead. Whether or not those Tallahassee debates go anywhere, the local shift is already happening.

Here’s the rub: calling something a “fee” doesn’t make it feel any different to the family writing the check. A doubled fire assessment and a steep stormwater hike reduce disposable income just like a millage increase would. The main difference is political optics — fees face less backlash and are easier to target, so they’ve become the preferred tool to backfill public-safety payrolls and rebuild aging pipes.

None of this argues for starving core services. Fire protection and stormwater systems are essential, and costs are rising. But honesty demands we treat compulsory assessments like what they are: tax-like charges that deserve the same transparency and accountability as any millage increase.

Three fixes would help. First, add a single “all-in burden” line on local dashboards that shows the combined annual impact of millage, assessments, and utility charges for a typical home. Second, require a true pay-for-performance link—publish the service improvements tied to each increase (response times, staffing levels, flooded-street reductions) and report against them quarterly. Third, sunset schedules automatically unless councils re-vote after a public check-in.

If local government needs more money, make the case and show the results. But let’s retire the fiction that calling it a fee makes it anything less than a tax in sheep’s clothing.

October 14, 2025Red Tape Florida

St. Petersburg permitting backlog is a Category 5 disaster for homeowners

A year after Hurricane Helene walloped Tampa Bay, St. Petersburg homeowners are still telling the same story: roofs tarped, repairs stalled, and permits stuck. In March, Mayor Ken Welch said the post-disaster permitting backlog would be cleared by the end of that month. But as recently as this week, residents told reporters they’re still waiting — and the city still hasn’t said how many permits remain in limbo. […]

October 2, 2025Red Tape Florida

St. Petersburg permitting backlog is a Category 5 disaster for homeowners

St. Pete said the permit backlog would be gone by March.

It’s October.

A year after Hurricane Helene walloped Tampa Bay, St. Petersburg homeowners are still telling the same story: roofs tarped, repairs stalled, and permits stuck. In March, Mayor Ken Welch said the post-disaster permitting backlog would be cleared by the end of that month. But as recently as this week, residents told reporters they’re still waiting — and the city still hasn’t said how many permits remain in limbo.

City Hall points to progress. Officials say they’ve issued more than 14,500 post-disaster emergency permits worth roughly $300 million and expect to return to “blue-sky” (normal) review times imminently. That’s real volume. It’s also not what matters to people who’ve watched one “two-week” timeline roll into the next while rainwater creeps behind tar paper.

Here’s what’s missing: numbers that mean something to a homeowner — outstanding permits by type, median days in review, and how many applications are kicked back for correction. FOX 13 says it repeatedly asked the city for the exact number of pending permits and got no answer. The public also deserves clarity on staffing: how many reviewers have been added, how many vacancies remain, and how much overtime has been authorized to burn the queue down.

Some residents have even received code-violation notices while they wait for approvals — the worst-case collision of bureaucracy with real life. If the city is truly on the cusp of clearing the backlog, it should be easy to publish the scoreboard: a daily-updated dashboard that shows count-by-permit-type, age-of-backlog, and projected clearance dates. Pair that with a plain-English “what to expect” timeline for common storm repairs and live office hours (virtual and in-person) where reviewers troubleshoot stuck applications on the spot.

There’s also a records piece here. Red Tape Florida has filed public records requests for: 1) the weekly backlog report (or closest internal equivalent) since January; 2) reviewer staffing levels, vacancies, and overtime records since November; 3) the number of code citations issued to properties with pending storm-repair permits; and 4) the city’s internal memos on the promised March clearance. If those documents match the rhetoric, great — publish them and show your work. If they don’t, own it and reset expectations with dates and data.

To be fair, St. Pete’s permitting office was already strained before Helene — demand surged along with construction, then two storms in two months pushed the workflow past its limits. But “we’re working on it” no longer works. Homeowners need finish lines, not press conferences. St. Pete can win back trust quickly with transparency, triage, and a little humility: tell people exactly where they stand, exactly what’s missing, and exactly when they can expect an inspection. Then hit those dates.

October 2, 2025Red Tape Florida

Permitting pivots: amnesty, capacity, and org charts — will they actually speed the queue?

Florida’s plan-review machinery is shifting in three places. If execution matches the headlines, applicants should see fewer re-review loops and faster close-outs. The question isn’t whether the moves sound good; it’s whether they move the metrics. […]

September 26, 2025Red Tape Florida

Permitting pivots: amnesty, capacity, and org charts — will they actually speed the queue?

Florida’s plan-review machinery is shifting in three places. If execution matches the headlines, applicants should see fewer re-review loops and faster close-outs. The question isn’t whether the moves sound good; it’s whether they move the metrics.

Pinellas County

Pinellas is waiving penalty fees for after-the-fact permits through Dec. 31, 2025 — an incentive to bring unpermitted storm repairs into the light. That’s good policy. It reduces underground work, gets inspectors on site, and lets homeowners fix paperwork without a punitive double-fee. The base permit still applies; the stick is gone so the carrot can work. What to watch: number of amnesty applications, median days from filing to inspection, and first-cycle pass rates. If those improve, this is a textbook compliance win.

Miami-Dade

Commissioners are reshuffling parts of environmental review as DERM is re-established as a stand-alone department. Supporters call it streamlining; skeptics worry about two lines instead of one. Treat this as an operations test: who owns the critical path end-to-end, and what are the posted service-level targets (days to first comments, re-review counts)? If the county publishes a single-owner RACI and hits SLAs, great—if not, applicants will just see a different badge at the same chokepoint.

St. Augustine

The city nudged short-term-rental registration fees for the first time since 2020. Staff say it’s cost recovery to fund inspections and oversight—not policy deterrence. That can be positive if the dollars are ring-fenced for throughput: an added inspector, faster re-inspections, and fewer recycling plans back to applicants. Ask to see the cost allocation and how many inspections the added funding will buy each month. The proof is in backlog shrinkage and complaint resolution time.

Bottom line for applicants: these are three different levers—amnesty, accountability, and capacity. Pinellas is the cleanest quick win if communication and scheduling keep pace. Miami-Dade needs a published owner and SLAs to be more than musical chairs. St. Augustine’s change will earn trust if the money clearly buys measurable speed.

Scorecard to track over the next quarter

- Pinellas: amnesty uptake, median days to inspection, % first-cycle approvals.

- Miami-Dade: before/after org chart, single process owner named, SLA performance.

- St. Augustine: inspection backlog trend, re-inspection lag, complaint resolution time.

Red Tape Florida

The Opportunity Still Exists — If We Want It

It’s easy to feel discouraged when examining what hasn’t materialized around the MagLab. There are no recognized clusters of private-sector R&D, no noticeable proliferation of startups, and no regional plan in place to activate this scientific powerhouse as an economic engine for North Florida. […]

September 19, 2025Red Tape Florida

The Opportunity Still Exists — If We Want It

Final part of a series

It’s easy to feel discouraged when examining what hasn’t materialized around the MagLab. There are no recognized clusters of private-sector R&D, no noticeable proliferation of startups, and no regional plan in place to activate this scientific powerhouse as an economic engine for North Florida.

But that reality is not set in stone.

The MagLab’s scientific output is elite. Its researchers are top-tier, and the facility’s presence in Tallahassee—backed by substantial NSF and state investment—is a rare asset.

And there are signs of life.

The Motor Drive Systems and Magnetics (MDSM) annual conference was held in Tallahassee for the first time this year and is returning in 2026.

Companies such as Biofront (disease testing kits) and Piersica (new battery technologies) have a toehold in Tallahassee.

What’s missing is a comprehensive strategy: a bold, shared vision among FSU, FAMU, TSC, the city, the county, state government and the business community. One that moves beyond resting on the lab’s reputation – and empty slogans like “Magnetics Capital of the World” — and actually delivers tangible results.

That means:

- FSU must open the gates — removing barriers to private-sector partnerships.

- The city must prioritize infrastructure, particularly power and site readiness for innovation-driven firms.

- The Chamber and economic development agencies must treat the MagLab as a keystone and persist when it comes to getting alignment among all the stakeholders listed above.

- And speaking of economic development, a collaboration between local government and the private sector must dramatically rework how OEV interacts with prospects to create a much higher level of agility and creativity.

- Leadership must emerge – that can convene stakeholders and tackle the issues that have led to 30 years of stagnation.

In the short term, here are 5 more quick wins that could be achieved in the next 24 months.

- Launch the MagLab Commercialization Challenge

An annual, high-visibility competition offering seed funding, lab access, and expert mentoring to startups or companies that can develop market-ready products from MagLab research. Winners commit to establishing or expanding operations in Tallahassee, turning lab breakthroughs into local jobs.

- Launch an “Innovation Sites” Map

Publish an online, publicly accessible map showing shovel-ready industrial parcels, with details on power capacity, broadband speed, and zoning — the same intel site selectors demand on day one.

- Secure a Signature Industry Partner

Land one high-visibility corporate tenant in advanced materials, clean energy, or biotech that actively uses MagLab capabilities, and announce it prominently.

- Host a National Tech + Science Summit in Tallahassee

Use the MagLab as the anchor venue for a multi-day, industry-heavy event — following the MDSM model but broadened to attract venture capital, suppliers, and manufacturing prospects.

- Set a Goal – and Achieve it

Commit to recruiting at least five MagLab-related companies and creating 250 new private-sector R&D/manufacturing jobs by the end of year two — and publish progress quarterly.

Conclusion

There is no way around it – Tallahassee’s inability to build an economy around the MagLab is a massive underachievement.

But it’s not too late to turn things around.

It starts with acknowledging how little has been done so far … and recognizing just how much is still possible through collaboration, humility, creativeness and energy.

September 19, 2025Red Tape Florida

Bay County’s Surplus Fee Shuffle

Bay County Commissioners are headed to the Florida Association of Counties conference with a little problem in their carry-on: millions in so-called “surplus” building fees that, by law, they’re supposed to refund. Instead, they’re trying to wish the whole thing away. […]

September 17, 2025Red Tape Florida

Bay County’s Surplus Fee Shuffle

Bay County Commissioners are headed to the Florida Association of Counties conference with a little problem in their carry-on: millions in so-called “surplus” building fees that, by law, they’re supposed to refund. Instead, they’re trying to wish the whole thing away.

Here’s the hitch. Florida Statute 553.80 isn’t subtle. It says building permit and inspection fees can’t be padded to turn a profit. They’re supposed to cover the actual cost of enforcing the building code. Nothing more. Nothing less. If counties collect too much, they either roll a limited amount forward to cover future costs or they refund the excess. Pretty straightforward.

But Bay County’s interpretation seems to be: “Thanks for the cash, citizens, we’ll hang on to it.”

The statute even includes a bright-line test. Counties can’t carry forward more than the average of their last four years of building code enforcement budgets. Anything above that is supposed to go back to the people who paid it — builders, homeowners, business owners. In other words, the folks who thought they were paying a fee for service, not donating to Bay County’s general slush fund.

And yet, Bay County is signaling it has no intention of writing refund checks. That’s not just bad optics, it’s potentially illegal. Attorney General opinions have long warned that when governments collect more than the actual cost of regulation, those “fees” start looking a lot like unauthorized taxes. And last we checked, counties don’t get to levy their own surprise taxes on construction projects.

So why is Bay County digging in? According to minutes and chatter around the FAC meeting, the surplus is being rebranded as a “reserve” — a rainy-day fund for future code costs. Never mind that state law already defined how big that reserve can be. It’s a little like trying to claim your kitchen junk drawer as a retirement plan.

The scale of the numbers matters here. Bay County’s 2022-23 Building Permit and Inspection Utilization Report (required by law to be posted online) shows collections far outpacing expenditures. The statute requires the report to include revenues, permit volumes, inspections, and costs — a transparency measure meant to prevent exactly this kind of gamesmanship. But transparency is useless if officials look right past the black-and-white rule: surplus beyond the cap has to be refunded.

This is more than a bookkeeping squabble. Builders and homeowners are already paying some of the highest input costs in memory — materials, labor, insurance. Now they find out Bay County may be pocketing fees in excess of actual costs. The law says those fees belong back in the wallets of the people who paid them.

If Bay County thinks it can out-lawyer the statute, it should brace for pushback. Other counties have been down this road before, and the pattern is clear: the longer you hold onto surplus fees, the worse the headlines and the higher the risk of legal challenge.

The kicker? All of this is playing out while county leaders beg for more trust from taxpayers and the Legislature. Nothing erodes credibility faster than ignoring the plain text of the law because it’s inconvenient.

Bay County can fix this two ways:

- Adjust fees downward so collections match costs.

- Refund the surplus as the statute requires.

What it can’t do — legally or ethically — is rebrand illegal surplus as “savings” and hope nobody notices. Spoiler alert: people are noticing.

So, the question heading into the FAC conference isn’t whether Bay County officials will discuss surplus fees. It’s whether they’ll follow the law or keep pretending the rules don’t apply to them.

September 17, 2025Red Tape Florida

Profit-sharing at a nonprofit? Fair’s bonus payouts, $25k signing bonus raise red flags

After Red Tape Florida first reported about the now-infamous $28,000 retirement watch, fallout was swift, with local and state officials demanding an investigation. Now, a new revelation: The incoming executive director of the Fair — who has defended the board’s decision to buy the luxury watch for her predecessor — herself received a $25,000 cash signing bonus upon being hired.[…]

Red Tape Florida

Profit-sharing at a nonprofit? Fair’s bonus payouts, $25k signing bonus raise red flags

“Profit sharing” at a nonprofit.

A $25,000 signing bonus.

A salary higher than the 20-year veteran a new director replaced.

Internal documents and interviews obtained by Red Tape Florida reveal how the North Florida Fair is rewarding its leaders — and why officials are demanding answers.

After Red Tape Florida first reported about the now-infamous $28,000 retirement watch, fallout was swift, with local and state officials demanding an investigation.

Now, a new revelation: The incoming executive director of the Fair — who has defended the board’s decision to buy the luxury watch for her predecessor — herself received a $25,000 cash signing bonus upon being hired.

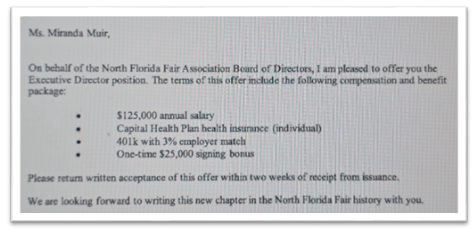

In a Dec. 5, 2024, offer letter from then-board Chair Rachel S. Pienta – who resigned in protest after the watch controversy — new fair manager Miranda Muir was offered a contract that included:

- $125,00 annual salary

- Health insurance

- 401k with 3 percent employer match

- A one-time $25,000 signing bonus

Minutes from the September 12, 2024, meeting reveal a discussion about the offer to Muir, who had been attending meetings since 2023 as the heir apparent to the director’s job and seemed a lock for the position.

While Harvey had not yet set a retirement date, the board moved toward making an offer to Muir. Initially, a base salary of $100,000 was discussed – below the long-time outgoing manager Harvey’s salary of $112,000. But board member Marcus Boston said he “went on the internet” and found a higher range

A committee was formed and there was also a mention of one-time moving expenses, but no mention of any sort of bonus. In the end, Muir received a base salary more than 10 percent higher than Harvey — and the $25,000 bonus.

Board member Steve Hurm, contacted this week by Red Tape Florida, said the board never discussed a signing bonus. “That information was never brought to me and if it had been I would have objected,” said Hurm.

Pienta declined to comment on the Muir offer saying in a statement: “I want to reiterate that it has been an honor and a privilege to serve on the North Florida Fair board over the years, including as Board President/Chair since 2024. I have stepped down from that position and will continue to focus on and strengthen our local 4-H programming and participation in the Fair moving forward.”

“Profit sharing”

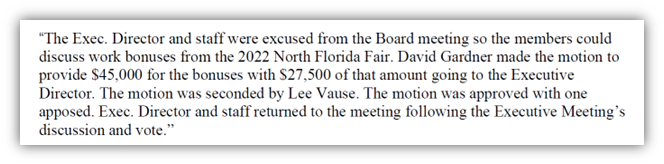

Meanwhile, the bonus money has been flowing at the fair for years and has been referred to at meetings and in minutes as “profit-sharing.”

When Hurm first heard that term he was alarmed.

“When a board member mentioned ‘profit-sharing,’ Hurm recalled, “I interrupted and said it was a nonsensical term – we’re a non-profit.”

By law, nonprofits don’t have “profits” to share. The IRS flatly prohibits it: no part of a charity’s earnings may inure to the benefit of insiders. Reasonable salaries? Sure. Profit sharing? That’s the language of Wall Street, not a 501(c)(3).

Watchdog groups warn boards constantly about even appearing to funnel surpluses to executives. Florida law is equally clear: compensation must be reasonable, but distributing income to officers is off-limits. And yet, here is a nonprofit agricultural fair association putting “profit sharing” in black and white — not whispered in a back room, but recorded as if it were standard practice.

It’s not just sloppy language. It’s a governance red flag that makes the organization look less like a community charity and more like a for-profit corporation cosplaying as one.

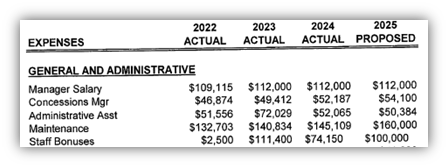

In 2023, Harvey received $27,500 in bonus money for strong performance of the annual fair. Minutes for 2024 aren’t available, but the 2025 proposed budget shows that total staff bonuses in 2024 were $74,000.

It is not clear if Harvey received a bonus this year for 2024 fair performance, but the 2025 total budget for bonuses rose to $100,000.

In the North Florida Fair’s most recent publicly available form 990 – from fiscal year 2023 – Harvey had a reported $178,000 in total compensation. Of that, according to schedule J on the form, $103,715 was base salary, $63,500 was bonuses, $7,619 was “other compensation” and $3,726 was retirement and deferred compensation.

Also that year, two board members of the non-profit were paid — $2,809 to George Kolias and $571 to Carole Abbott. The watch controversy drew withering criticism from Leon County Commissioners Bill Proctor, Christian Caban and Brian Welch at Wednesday’s meeting, while Commissioner Nick Maddox did not appear as concerned. Hanging over the issue is $30 million in proposed Blueprint funding to enhance the fairgrounds. That funding was frozen at a recent Blueprint meeting by a 9-3 vote with Tallahassee Mayor John Dailey, City Commissioner Dianne Williams-Cox and Maddox voting against.

Also a factor is Leon County’s lease with the Fair.

But before the retirement watch controversy broke, it was fair board members who thought they had the upper hand in negotiations with Leon County over the fair’s $1 lease.

Board member Lee Vause Jr., who remains on the board after supporting the retirement gift, was quoted in the minutes responding to a conversation about the Fair’s lease with Leon County by saying: “We don’t have to negotiate lease with County. They want something, not the Fair. Fair is in better position, not County. Wait for County to get in touch with the Fair.”

September 17, 2025Red Tape Florida